BitVMX – Computation Without Consensus Change

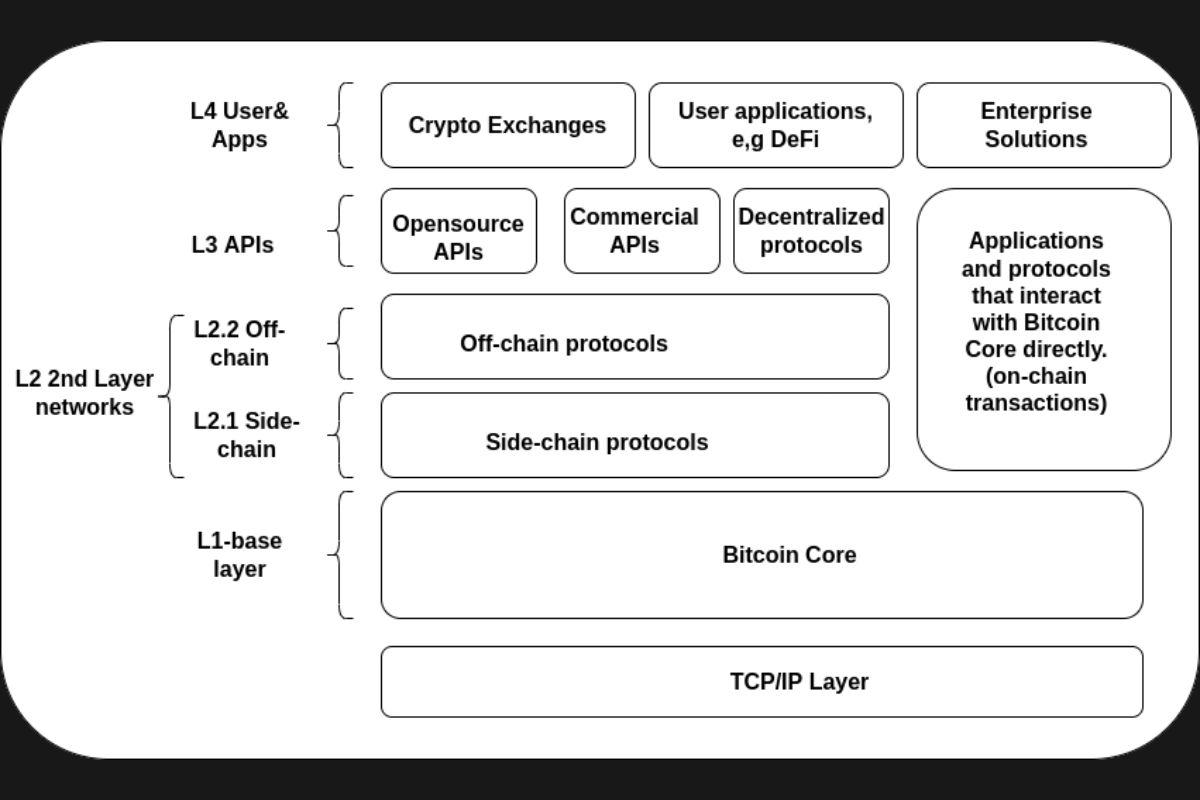

For Bitcoin to support complex financial applications, such as lending, swaps, and on-chain yield, without altering its base protocol, it needs an external computation layer. BitVMX represents the most promising implementation of this idea. As an evolution of BitVM, BitVMX enables arbitrary computation over Bitcoin through off-chain execution combined with on-chain fraud proofs. It allows developers to simulate the behavior of a virtual CPU, execute smart contract logic, and bridge native BTC across Layer-2s, all while preserving Bitcoin’s consensus rules. This module explains how BitVMX works, how it differs from prior Bitcoin extension attempts, and why it is becoming foundational for Bitcoin-native DeFi and Layer-2 architecture.

Origins: From BitVM to BitVMX

The original BitVM was introduced in October 2023 as a way to verify complex computations on Bitcoin using its native opcodes. BitVM itself is not a programming language or execution environment—it is a verification framework. Computations are executed off-chain, but their validity is proven on-chain using hash commitments and challenge-response mechanisms. This makes it possible to run logic as complex as virtual CPUs or Ethereum-like smart contracts without needing Bitcoin to natively process them.

However, BitVM in its original form had several limitations. Its design relied heavily on manual data handling, and its execution time was impractically slow for any real-world use. BitVMX was developed in response to these constraints. It improves performance, introduces reusable computation primitives, and defines a standardized framework for Layer-2 design. BitVMX uses a virtualized architecture modeled after general-purpose instruction sets (such as RISC-V), allowing developers to write programs in high-level languages and compile them for verifiable execution.

BitVMX does not propose any soft fork or consensus-layer changes. All of its logic is handled through Bitcoin’s existing functionality – mainly OP_IF, OP_HASH160, OP_CHECKSIG, and script-based branching. This strict adherence to Bitcoin’s current rule set is key to its appeal. It avoids governance conflict, ensures backward compatibility, and inherits Bitcoin’s security guarantees without introducing systemic risk.

How BitVMX Enables Computation and Bridges

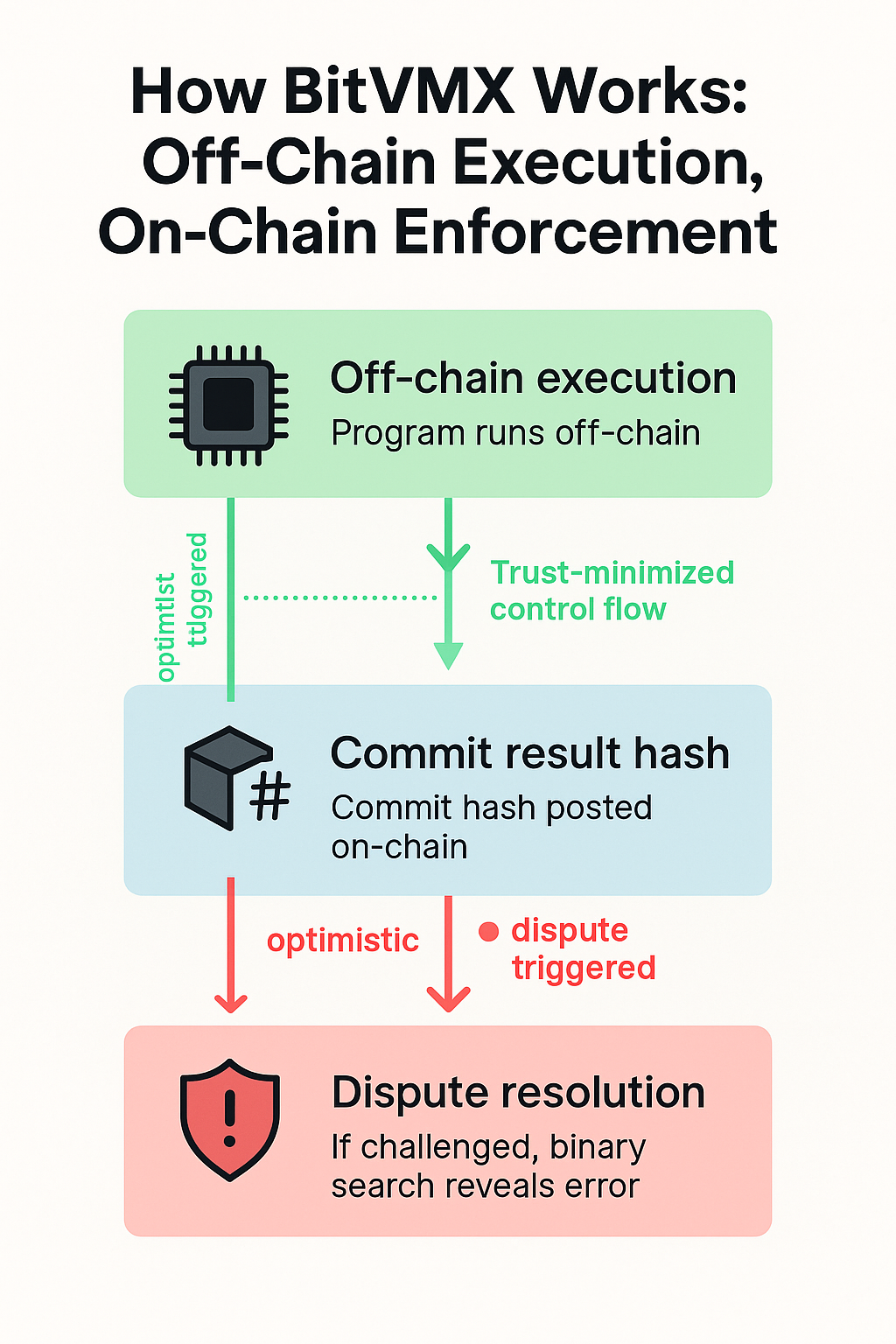

At the core of BitVMX is the idea of “disputable computation.” A prover runs a program off-chain and posts a cryptographic commitment to the result. If no one challenges the result within a designated dispute window, the output is accepted. If challenged, a binary search-style resolution process is triggered, where the computation is broken down into steps, and the verifier checks only the disputed parts on-chain. This drastically reduces the cost of verification while preserving trust-minimization.

This architecture makes it possible to construct Layer-2 rollups, decentralized bridges, and Bitcoin-native smart contracts. For example, two parties could use a BitVMX program to lock funds in a Bitcoin transaction and unlock them based on the output of an off-chain contract. A rollup can batch thousands of transactions, execute them off-chain using BitVMX, and commit the final state root to Bitcoin, with fraud proofs enabling rollback if the result is invalid.

BitVMX bridges follow the same logic. BTC is locked on the base layer in a vault contract. An off-chain protocol (secured by BitVMX rules) governs minting and burning of tokens on a Layer-2. Disputes over fraudulent minting can be resolved on Bitcoin using the same challenge-response framework. Because no wrapped tokens or third-party custodians are required, these bridges are more secure and align with Bitcoin’s ethos of trustless verification.

Security Model and Execution Guarantees

Unlike sidechains or federated bridges, BitVMX inherits Bitcoin’s security model without making any changes to the consensus algorithm. This is accomplished through adversarial incentives: the cost of cheating exceeds the cost of behaving honestly, and honest verifiers can always win disputes. Execution is not enforced via mining consensus but through script validation and time-locked outputs. The design ensures that the “honest minority” assumption holds, similar to Ethereum’s optimistic rollups.

The main security risks arise not from the BitVMX framework itself but from how it is implemented and used. If dispute windows are too short or if the on-chain logic for challenge resolution is flawed, it could allow malicious actors to escape with funds or submit invalid state transitions. Careful parameter design, community verification, and open-source tooling are essential to minimizing this risk.

It is also worth noting that while BitVMX provides a strong fraud-proof layer, it does not yet support zero-knowledge proofs. Unlike ZK rollups, which offer instant finality and privacy, BitVMX systems require time for dispute resolution. However, this trade-off also keeps them simpler and easier to audit, particularly for developers focused on performance and modular design.

Developer Tooling and Programming Environments

One of the primary barriers to adoption for BitVM was the lack of developer tooling. BitVMX addresses this by offering a complete toolchain for writing, testing, and deploying disputable programs. Developers can write logic in familiar high-level languages and compile them to virtual instruction sets compatible with the BitVMX framework.

Some early toolchains use LLVM-based compilers or Rust-based interpreters to simulate contract logic before producing hash commitments for the Bitcoin scripts. Debugging tools, gas estimation simulators, and template contracts are also being released to support smart contract developers transitioning from Ethereum or other ecosystems.

In addition, several GitHub repositories are actively developing reference implementations of BitVMX programs, including virtual CPU emulators, testnets for BitVMX-based rollups, and dispute resolution bots. These tools will play a central role in onboarding the first generation of Bitcoin-native dApps, allowing engineers to build expressive applications without deep familiarity with Bitcoin Script.

Comparison to Other Bitcoin Extension Models

BitVMX distinguishes itself from past attempts to extend Bitcoin’s functionality in several key ways. Unlike federated sidechains such as Liquid or RSK, it does not require a fixed set of signers or a separate consensus mechanism. Unlike Lightning Network, which is limited to payment channels and suffers from routing challenges, BitVMX supports arbitrary logic and state management. Compared to previous optimistic rollups on Bitcoin, BitVMX offers finer-grained control and better integration with off-chain computation environments.

Its closest parallel may be Ethereum’s fraud-proof rollups, such as Optimism or Arbitrum. However, the execution environments differ. BitVMX programs are limited by Bitcoin’s Script constraints, and every interaction must be modeled as a challenge-response game. This makes the system more conservative but also more secure by design. While Ethereum can rely on sequencers and L2-native validators, BitVMX relies solely on Bitcoin’s native validation and external watchers for enforcement.