Lightning Network and Payment Channel Architecture

Here, learners explore how the Lightning Network enables fast and cheap BTC payments by using payment channels and off-chain routing. The module covers how Lightning works technically, the role of HTLCs, routing challenges, real-world usage, and the latest improvements in wallet UX and liquidity.

Payment channel structure and HTLCs

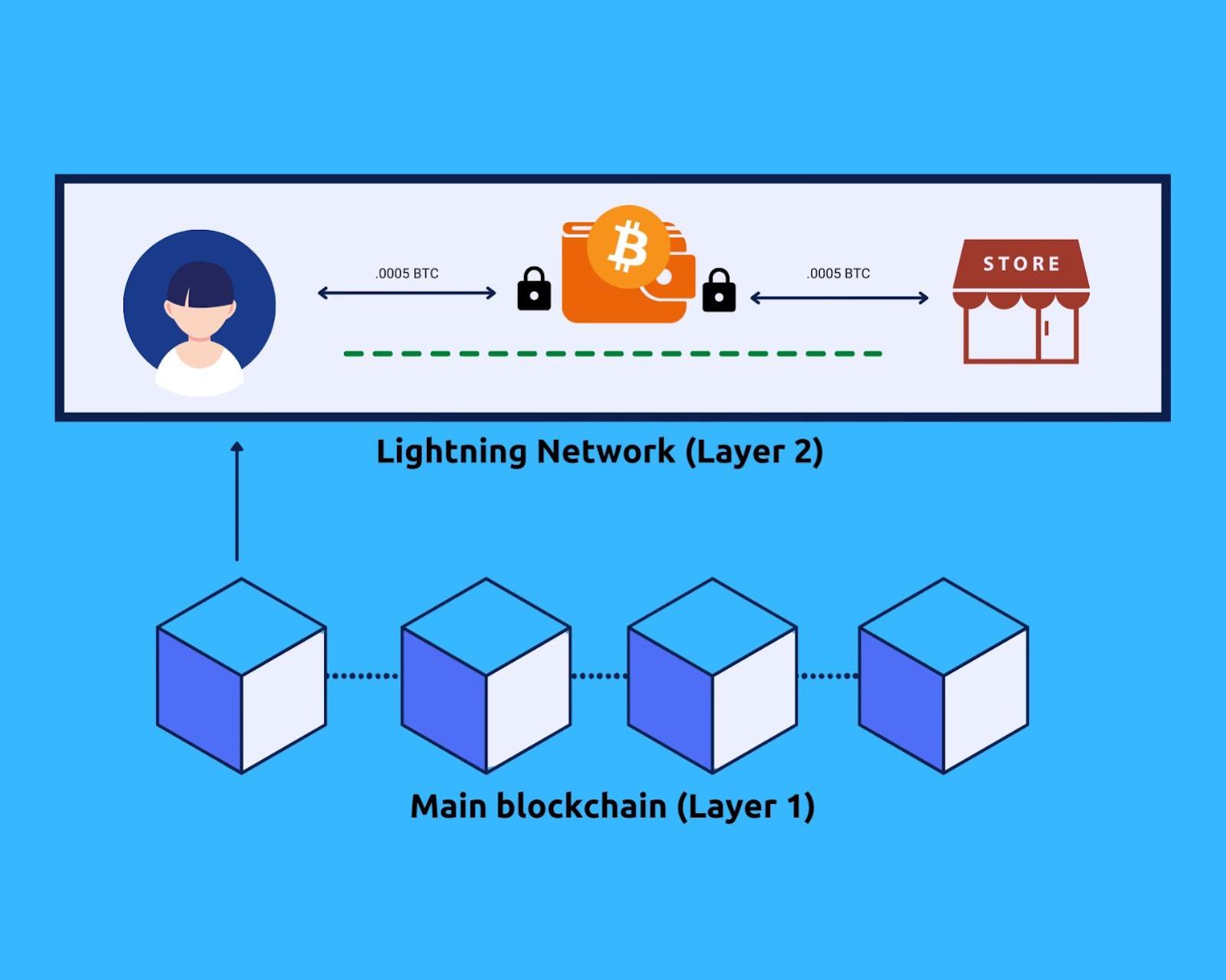

Bitcoin’s base layer is not designed for fast, high-volume payments. The Lightning Network was introduced as a solution to this constraint. It enables nearly instant Bitcoin transfers by moving the majority of activity off-chain, while still relying on Bitcoin’s main chain for final settlement. This module explains the architecture of the Lightning Network, how payment channels work, the routing mechanism that powers multi-hop payments, and the real-world adoption of Lightning in 2025.

At its core, the Lightning Network is built on the concept of payment channels. A payment channel is a two-party agreement where both participants lock up a certain amount of bitcoin on the blockchain in a shared multisignature address. This address is created using a funding transaction that is recorded on-chain. Once the channel is established, the participants can send payments to each other by exchanging updated signed balances, without creating any further transactions on the base layer.

These updates are not recorded on-chain unless the channel is closed or one party broadcasts a dispute. Instead, the two parties maintain an up-to-date record of who owns what portion of the total channel capacity. Since only the final state is eventually broadcasted, this allows thousands of payments to take place between two users without burdening the blockchain.

To enable payments across a network of users who are not directly connected by a channel, the Lightning Network uses Hashed Timelock Contracts (HTLCs). HTLCs allow trustless, atomic multi-hop payments. Each hop in the payment path locks the funds using a cryptographic hash that can only be unlocked with a secret preimage. The final recipient reveals the secret to claim the funds, and each intermediary node along the path can use this secret to claim their corresponding payment. The timelock component ensures that if a payment fails to complete within a certain time, the funds can be safely refunded.

HTLCs form the backbone of Lightning’s routing system, enabling decentralized payments without requiring any central coordination. They also allow for conditional payments and are foundational to applications like cross-chain swaps and trust-minimized escrow.

Opening, routing, and closing channels

To use Lightning, users must first open a channel. This involves creating an on-chain funding transaction, which locks bitcoin into a multisignature address shared between the two parties. Once the transaction confirms, the channel becomes active and can be used for instant payments. The initial balance of the channel determines how much each party can send. For example, if Alice opens a 1 BTC channel with Bob and deposits the full amount, she can send up to 1 BTC to Bob before the balance reaches zero.

Payments are routed through the network using a pathfinding algorithm. Each Lightning node maintains a local view of the network’s public graph, which includes available channels, their capacities, and fees. When Alice wants to pay Charlie but doesn’t have a direct channel, the network may route the payment through Bob or other intermediaries. The selected path must have sufficient liquidity in the right direction, and each hop earns a small routing fee.

Closing a channel can happen cooperatively or unilaterally. In a cooperative close, both parties sign a final state and broadcast it to the blockchain, returning their respective balances. In a unilateral close, one party initiates the close by broadcasting the latest signed state. This triggers a timelocked period during which the counterparty can contest the transaction if an outdated state is used. This mechanism discourages fraud but also requires participants to monitor the chain for potential disputes.

The process of opening and closing channels creates friction for users, particularly in mobile wallets where liquidity constraints are more visible. However, once channels are funded and balanced, payments can be executed instantly and at a fraction of the cost of on-chain fees.

Lightning apps and wallets in 2025

Since its launch in 2018, the Lightning Network has matured into a functioning payment layer with a growing ecosystem of wallets, apps, and integrations. By 2025, Lightning supports a wide range of use cases from global remittances to real-time content monetization.

Strike, developed by Zap, has gained traction in countries with high inflation or limited access to banking infrastructure. It allows users to send fiat over the Lightning Network using bitcoin as the settlement rail. Users in the United States can send dollars to users in El Salvador or Argentina, where the recipient receives local currency, bypassing traditional remittance services.

Phoenix Wallet, developed by ACINQ, offers a non-custodial mobile experience with automated channel management. It opens and funds channels in the background, minimizing friction for the user. Breez Wallet provides similar functionality with added features like podcast streaming and point-of-sale integrations.

Mutiny Wallet is an emerging project that integrates both Lightning and privacy tools such as Fedimint. It allows users to manage Lightning payments and eCash tokens from the same interface. This convergence of privacy and scalability tools reflects the direction of wallet development in 2025.

These applications have improved onboarding, but challenges remain. Liquidity provisioning, inbound capacity, and backup mechanisms are still complex for many users. Mobile wallets must manage dynamic fee environments and routing failures. Despite these challenges, the user experience has improved significantly, enabling more people to use Lightning without understanding its underlying mechanics.

Channel jamming, liquidity rebalancing, and privacy upgrades

The Lightning Network is not without limitations. One issue is channel jamming, where attackers or misconfigured nodes can block liquidity by initiating payments that are never completed. Since HTLCs reserve capacity along a route until they expire or settle, a malicious user can create many pending payments to tie up bandwidth. This degrades the network’s reliability and can disrupt legitimate transactions.

To mitigate this, developers have proposed solutions such as upfront fees and rate-limiting mechanisms. Some implementations now require small payments even for failed routing attempts, disincentivizing spam. Other strategies include using trampoline routing or blinded paths to reduce the load on individual nodes.

Liquidity management is another persistent challenge. Since Lightning payments depend on channel balances in specific directions, users must periodically rebalance their channels. This can involve circular payments through the network or using external services to move liquidity. Automatic rebalancing tools and liquidity marketplaces have emerged to address this issue, but efficient liquidity use remains an open problem.

Privacy is also limited in Lightning, particularly in public channel announcements and payment path tracing. Improvements like blinded routes, which obscure the path a payment takes, have been introduced. Onion routing and rendezvous routing also enhance privacy by hiding sender and recipient identities. However, full anonymity is still not guaranteed, especially when interacting with regulated exchanges or custodial services.

Despite these issues, ongoing protocol upgrades continue to address Lightning’s weaknesses. Improvements to gossip efficiency, channel discovery, and zero-confirmation channels are underway. These changes aim to reduce onboarding friction, increase reliability, and support higher throughput without compromising trust assumptions.

Institutional adoption and 2025 network metrics

As of mid-2025, the Lightning Network has surpassed 5,000 BTC in publicly visible capacity, with thousands of active nodes and tens of thousands of channels. However, public metrics only reflect part of the picture. Many large institutions use private channels that are not broadcast to the network graph, making the total volume of routed payments significantly higher than what is visible on-chain.

Financial institutions and fintech platforms have begun integrating Lightning for cross-border settlements and micropayments. Exchanges now offer Lightning withdrawals and deposits as standard, reducing load on the main chain. Bitcoin payment processors such as OpenNode and IBEX enable merchants to accept Lightning payments globally, often settling in local currency.

Content creators use Lightning to receive streaming payments through Podcasting 2.0 and social tipping. In emerging markets, Lightning wallets are being adopted for everyday purchases, especially in countries where inflation and capital controls hinder access to reliable money.

Infrastructure providers such as Voltage, Amboss, and River offer managed nodes, liquidity services, and analytics for businesses building on Lightning. This professionalization of Lightning tooling has made it easier for startups and platforms to integrate payments without running complex infrastructure.

The network still faces hurdles, particularly in liquidity fragmentation and UX standardization. But the presence of regulated custodians, institutional-grade APIs, and mobile-first wallets signals that Lightning is no longer experimental. It is becoming a functional payment layer for Bitcoin and a foundation for the broader Layer-2 ecosystem.