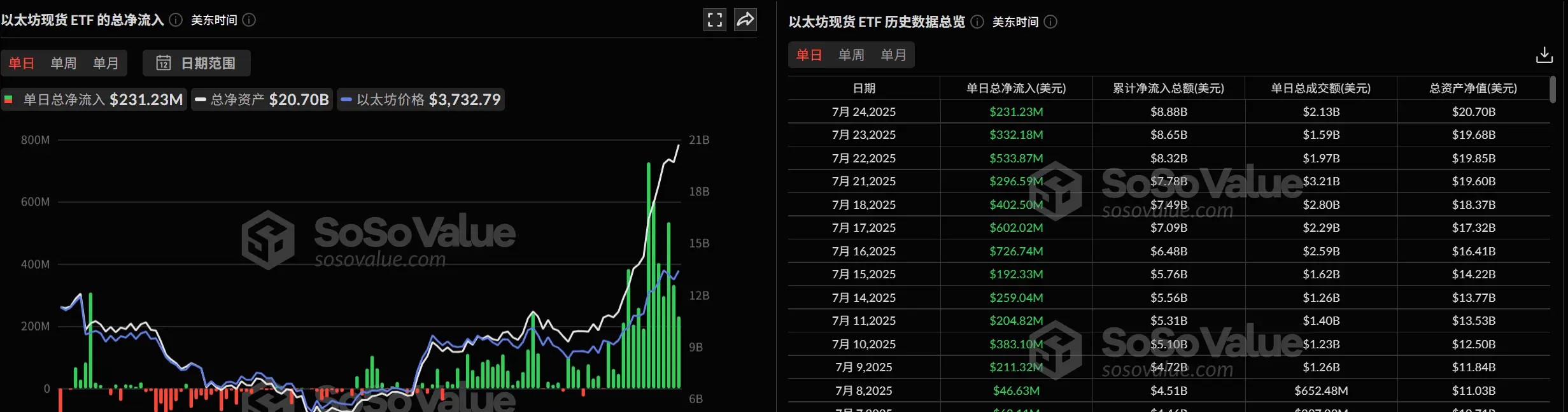

According to the latest monitoring results from blockchain data analysis experts, SharpLink Gaming has recently transferred its holdings of 145 million USDC stablecoins to the wallet address of the well-known digital asset financial service company Galaxy Digital.

Considering that SharpLink Gaming has primarily conducted Ethereum (ETH) purchases through Galaxy Digital, industry analysts speculate that this large-scale fund transfer likely indicates that SharpLink Gaming is preparing for a new round of Ethereum accumulation.

This move has attracted widespread attention in the cryptocurrency mar

View OriginalConsidering that SharpLink Gaming has primarily conducted Ethereum (ETH) purchases through Galaxy Digital, industry analysts speculate that this large-scale fund transfer likely indicates that SharpLink Gaming is preparing for a new round of Ethereum accumulation.

This move has attracted widespread attention in the cryptocurrency mar