更多

- 话题1/3

8k 热度

4k 热度

9k 热度

6k 热度

3k 热度

- 置顶

- 🎉Gate 2025 上半年社区盛典:内容达人评选投票火热进行中 🎉

🏆 谁将成为前十位 #Gate广场# 内容达人?

投票现已开启,选出你的心头好

🎁赢取 iPhone 16 Pro Max、限量周边等好礼!

📅投票截止:8 月 15 日 10:00(UTC+8)

立即投票: https://www.gate.com/activities/community-vote

活动详情: https://www.gate.com/announcements/article/45974

- 📢 #Gate广场征文活动第二期# 正式启动!

分享你对 $ERA 项目的独特观点,推广ERA上线活动, 700 $ERA 等你来赢!

💰 奖励:

一等奖(1名): 100枚 $ERA

二等奖(5名): 每人 60 枚 $ERA

三等奖(10名): 每人 30 枚 $ERA

👉 参与方式:

1.在 Gate广场发布你对 ERA 项目的独到见解贴文

2.在贴文中添加标签: #Gate广场征文活动第二期# ,贴文字数不低于300字

3.将你的文章或观点同步到X,加上标签:Gate Square 和 ERA

4.征文内容涵盖但不限于以下创作方向:

ERA 项目亮点:作为区块链基础设施公司,ERA 拥有哪些核心优势?

ERA 代币经济模型:如何保障代币的长期价值及生态可持续发展?

参与并推广 Gate x Caldera (ERA) 生态周活动。点击查看活动详情:https://www.gate.com/announcements/article/46169。

欢迎围绕上述主题,或从其他独特视角提出您的见解与建议。

⚠️ 活动要求:

原创内容,至少 300 字, 重复或抄袭内容将被淘汰。

不得使用 #Gate广场征文活动第二期# 和 #ERA# 以外的任何标签。

每篇文章必须获得 至少3个互动,否则无法获得奖励

鼓励图文并茂、深度分析,观点独到。

⏰ 活动时间:2025年7月20日 17

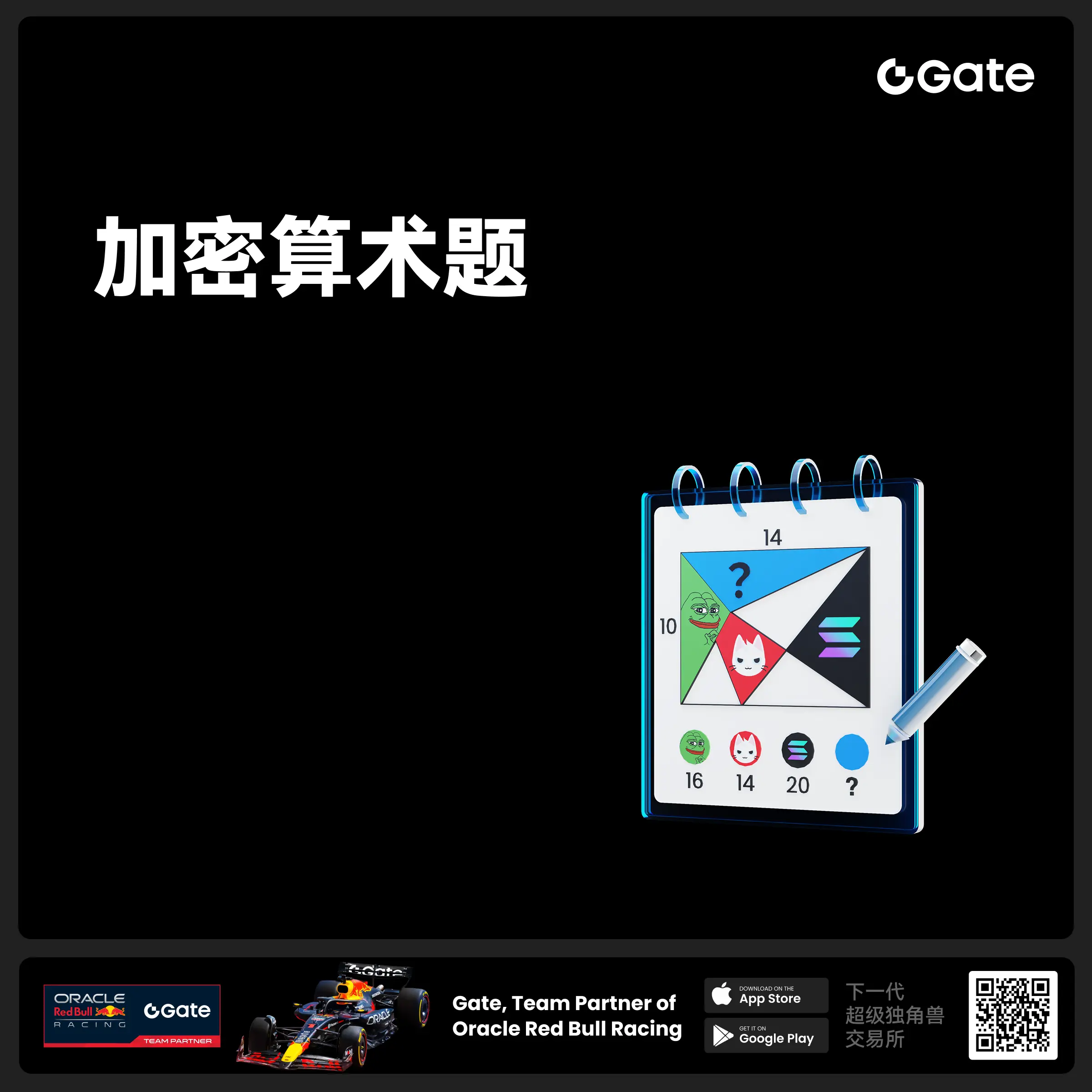

- 🧠 #GateGiveaway# - 加密算术题挑战!

你能解出这道加密题吗?

💰 $10 合约体验券 * 4 位获奖者

参与方式:

1️⃣ 关注 Gate广场_Official

2️⃣ 点赞此条动态贴文

3️⃣ 在评论中留下你的答案

📅 截止时间:7 月 22 日 12:00(UTC+8)

- 📢 ETH冲击4800?我有话说!快来“Gate广场”秀操作,0.1 ETH大奖等你拿!

牛市预言家,可能下一个就是你!想让你的观点成为广场热搜、赢下ETH大奖?现在就是机会!

💰️ 广场5位优质发帖用户+X浏览量前5发帖用户,瓜分0.1 ETH!

🎮 活动怎么玩,0门槛瓜分ETH!

1.话题不服来辩!

带 #ETH冲击4800# 和 #ETH# 在 广场 或 K线ETH下 围绕一下主题展开讨论:

-ETH是否有望突破4800?

-你看好ETH的原因是什么?

-你的ETH持仓策略是?

-ETH能否引领下一轮牛市?

2. X平台同步嗨

在X平台发帖讨论,记得带 #GateSquare# 和 #ETH冲击4800# 标签!

把你X返链接提交以下表单以瓜分大奖:https://www.gate.com/questionnaire/6896

✨发帖要求:

-内容须原创,字数不少于100字,且带活动指定标签

-配图、行情截图、分析看法加分,图文并茂更易精选

-禁止AI写手和灌水刷屏,一旦发现取消奖励资格

-观点鲜明、逻辑清晰,越有料越好!

关注ETH风向,创造观点价值,从广场发帖开始!下一个牛市“预言家”,可能就是你!🦾🏆

⏰ 活动时间:2025年7月18日 16:00 - 2025年7月28日 23:59(UTC+8)

【立即发帖】 展现你的真知灼见,赢取属于你的ETH大奖!

- 🎉 #Gate Alpha 第三届积分狂欢节 & ES Launchpool# 联合推广任务上线!

本次活动总奖池:1,250 枚 ES

任务目标:推广 Eclipse($ES)Launchpool 和 Alpha 第11期 $ES 专场

📄 详情参考:

Launchpool 公告:https://www.gate.com/zh/announcements/article/46134

Alpha 第11期公告:https://www.gate.com/zh/announcements/article/46137

🧩【任务内容】

请围绕 Launchpool 和 Alpha 第11期 活动进行内容创作,并晒出参与截图。

📸【参与方式】

1️⃣ 带上Tag #Gate Alpha 第三届积分狂欢节 & ES Launchpool# 发帖

2️⃣ 晒出以下任一截图:

Launchpool 质押截图(BTC / ETH / ES)

Alpha 交易页面截图(交易 ES)

3️⃣ 发布图文内容,可参考以下方向(≥60字):

简介 ES/Eclipse 项目亮点、代币机制等基本信息

分享你对 ES 项目的观点、前景判断、挖矿体验等

分析 Launchpool 挖矿 或 Alpha 积分玩法的策略和收益对比

🎁【奖励说明】

评选内容质量最优的 10 位 Launchpool/Gate

Bitcoin Treasury Companies Added $810M BTC This Week As Price Topped $123K

Between July 14 and 19, 58 Bitcoin treasury updates were recorded, coinciding with Bitcoin’s price reaching $123,000 as 21 companies added approximately $810 million in BTC to their corporate treasuries. The roundup also included four new treasuries, 17 future treasury announcements, 11 active BTC fundraising plans, and five other related disclosures.

Advertisement Advertisement

Corporate Bitcoin Treasury Surge as Global Companies Bolster BTC Holdings

According to an X post by btcNLNico, Saylor’s Strategy led all Bitcoin treasury acquisitions with 4,225 BTC, followed by Metaplanet with 797 BTC. France-based Sequans added 683 BTC, while the UK’s The Smarter Web Company contributed 325 BTC.

Other notable additions came from Semler Scientific (210 BTC), DigitalX (166.8 BTC), and Cango (149 BTC). The purchases spanned companies from the U.S., Japan, the U.K., France, Canada, China, and Sweden.

Four companies launched new Bitcoin treasury plans, adding $96.39 million BTC combined. Bullish’s IPO filing revealed a $92 million BTC holding. Satsuma Technology began its treasury with $3.37 million BTC, while BTC Digital allocated $1 million (about 8.5 BTC), and Active Energy entered the market with an undisclosed amount under 1 BTC.

Seventeen new corporate treasury plans were announced. Combined, they plan to add 44,200 BTC in the coming months. The Bitcoin Standard Treasury Company (BSTR), led by Blockstream’s Adam Back, is expected to hold around 30,000 BTC.

Other notable participants include Volcon ($500 million treasury strategy), Click Holdings ($100 million BTC and SUI fund), OFA Group ($100 million equity), and Cycurion ($10 million crypto treasury plan).

More companies are implementing Bitcoin treasury reserves as its price continues to rise. After BTC’s rally to $123,000, the net worth of its founder topped $133 billion. The rise in net worth caused Satoshi Nakamoto to become the eleventh-richest person in the world.

Advertisement Advertisement

Corporations Reveal Bitcoin Funding and Acquisition Plans

BTC Treasury firms also recorded 11 funding initiatives for future BTC purchases, with $47 million already secured. The Smarter Web Company raised $23.5 million, Belgravia Hartford raised $9.7 million, and The Blockchain Group raised $7 million. H100 Group, Vaultz Capital, and LQWD also announced multi-million-dollar rounds targeting Bitcoin buys.

Additional corporate moves show longer-term BTC commitments. Matador Technologies filed a $656 million base shelf prospectus, while Bitcoin Treasury Corporation filed for a $219 million base shelf prospectus. Other filings include B Treasury Capital’s $20.7 million ATM facility and LQWD’s $7.3 million ATM program.

Additionally, Bitcoin Treasury firms have noted more strategic shifts. Tao Alpha rebranded to Satsuma Technology, appointing a new CEO. Matador revealed a long-term BTC acquisition roadmap.

The activity indicates an increasing institutional demand for the cryptocurrency. Bitcoin’s rise to a new all-time high of $123,000 this week reflects confidence in it as a massive store of value.

Advertisement

✓ Share: