The Dilemma of Pump.fun: Market Share Erosion, Legal Accusations, and Gen Z Team Cashing Out

“The most interesting place on the internet”—that’s how Pump.fun’s three Gen Z founders once described their brainchild. Today, the phrase reads more like a punchline pulled from a playbook of dark humor.

As of July 2025, the former meme coin disruptor—celebrated for igniting the “one-click token launch” trend—now faces an unprecedented crisis of trust and major market headwinds.

Pump.fun is grappling with commercial pressures as rivals capture market share and key metrics nosedive. Even more daunting, it now faces U.S. legal scrutiny, battling securities fraud and RICO felony charges. Pump.fun’s journey began in a frenzy—and is now being tested by the very mania it helped unleash.

Where Trust Unraveled

July 2025: one decision changed the course of everything.

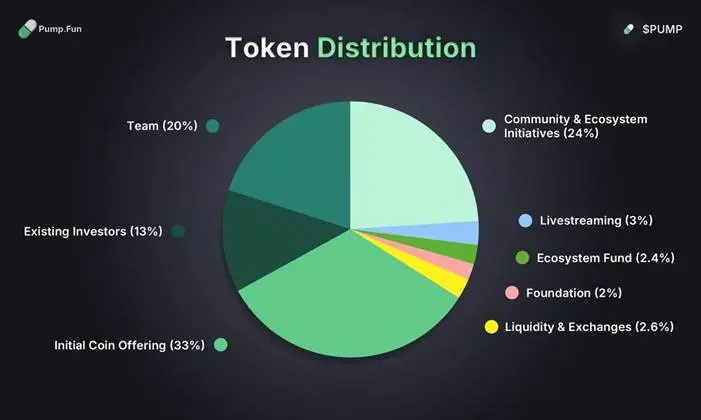

Pump.fun announced the launch of its own token, PUMP, touting a fully diluted valuation of $4 billion. Instead of a proud milestone, it became the inflection point that shook the platform’s community to its core.

The irony is evident: although the platform founders had built a reputation on the belief that “every presale is a scam,” they conducted a major presale of their own for PUMP. To the community, this was an outright display of hypocrisy and betrayal.

Jocy, founder of leading VC IOSG Ventures, publicly described the move on X as a high-risk “exit liquidity” event, warning that raising at a $4 billion valuation for a meme token in a bear market was dangerously overleveraging the future. The market’s fears materialized fast.

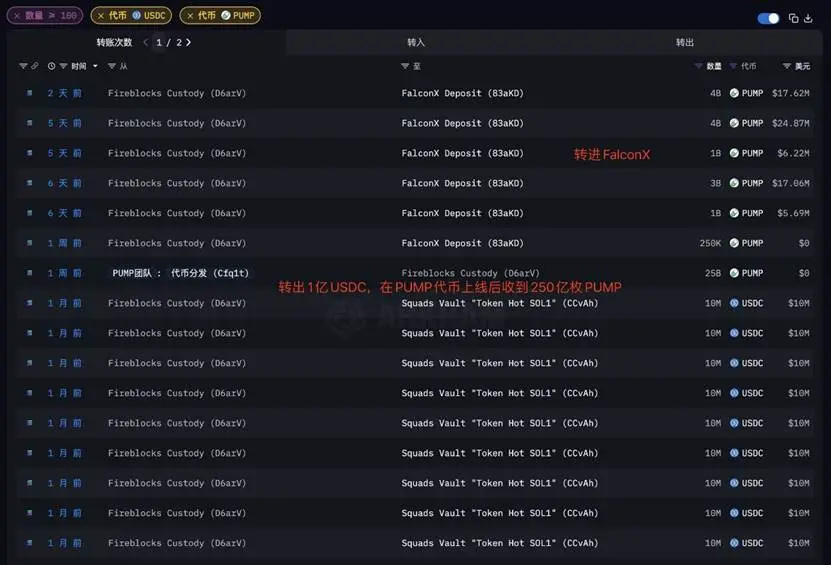

CoinMarketCap data showed the token’s price nosedived 75% just hours after launch. At publication, PUMP was trading at $0.0024 USDT—more than 30% below its $0.004 USDT public sale price.

The on-chain numbers were even more disturbing: 340 whale wallets coordinated a selloff, holding over 60% of presale tokens. According to X user EmberCN, just two private round wallets dumped $141 million in tokens, pocketing nearly $40 million in gains.

On social media, euphoria turned to despair overnight. “We thought we’d finally caught a break—instead, we became exploited by others.” That sense of being duped and fleeced spread like wildfire, severely undermining the community trust that once powered Pump.fun’s growth.

Share Collapse, Business Model Under Siege

That erosion of trust showed up immediately in the data.

Rival LetsBONK.fun was capturing its market dominance at breakneck pace. Dune Analytics revealed that Pump.fun’s share of new token launches nosedived from 90% to 24% in a single month—while LetsBONK.fun increased from 5% to 64%. Beneath this shift is a fundamental clash in business philosophy.

Pump.fun took a centralized cut from every launch, while LetsBONK.fun built success by channeling 58% of platform revenues to buy back and burn ecosystem tokens—fueling a virtuous cycle of shared value and trust.

As the situation deteriorated, CoinCentral reported the team’s multimillion-dollar buyback plans. The market dismissed it as “using retail to hold positions at the peak.” Analysts noted the project sold at $0.004, then bought back at $0.0064 with platform income—a 60% markup, all for price support.

The buyback propped up prices temporarily, but couldn’t repair the shattered foundation of value and confidence. Meanwhile, global regulators were increasing regulatory scrutiny.

In December 2024, after a warning from the UK Financial Conduct Authority (FCA), Pump.fun was forced to shut off 9% of its traffic—its UK users.

This was no isolated incident; it was the inevitable reckoning for a “viral” growth model under the regulatory lens. Pump.fun spiraled into a negative feedback loop: intensifying competition eroded revenue, shrinking income weakened buyback firepower, falling token prices sapped confidence, and user attrition only accelerated.

RICO Tightens the Noose

The toughest blow came from the legal arena. Initially, several class actions accused every meme token on the platform of being an unregistered security. Law firms like Wolf Popper LLP pushed a “Joint Issuer Theory,” asserting the platform was deeply enmeshed in the creation, trading, and liquidity of tokens—not just a neutral tech provider.

In July 2025, the legal war escalated sharply. The revised Aguilar suit added charges under the RICO Act—a law typically used to prosecute organized crime.

The defendant list grew to include the Solana Foundation, Solana Labs, and even their co-founders as alleged architects, beneficiaries, and accomplices in the fraud. The implications reach far beyond Pump.fun, fundamentally challenging the liability boundaries for the entire Solana ecosystem.

Does core infrastructure like Solana have an obligation to police or supervise its ecosystem stars? This lawsuit put every public chain on notice: alliances with ecosystem projects may be much riskier than previously thought. Under RICO, the core allegations include wire and securities fraud, unlicensed money transmission, and aiding and abetting money laundering.

The most serious allegation: North Korea’s Lazarus hacker group allegedly used Pump.fun’s meme tokens to launder funds stolen in the Bybit hack.

Governance Gaps—No Defense Against Insiders

Perhaps most shocking was the betrayal from within.

On May 16, 2024, Pump.fun suffered a $1.9 million exploit—but the attacker wasn’t an outside hacker, but a resentful former employee.

Self-identified as “Stacc,” the former employee confessed on X, citing revenge and disdain for “terrible bosses” as his motivation. A technical review found that the exploit wasn’t due to a smart contract flaw, but rather the abuse of administrator privileges.

With privileged access, the insider illicitly obtained withdrawal rights, then used flash loans to sweep the supply of multiple tokens—diverting the initial decentralized exchange (DEX) liquidity pool. While touting protection against meme coin rug pulls, Pump.fun was wide open to a rogue employee with a grudge.

The episode is a stark warning: Pump.fun’s breakneck growth left it exposed to massive governance and security blind spots.

From Stopping Rug Pulls to Pulling Its Own

The saga began amid the 2024 “Solana meme coin mania.” Developers and speculators worldwide flocked to Solana, chasing the fabled 100x token. But creating a new token and launching its first liquidity pool (LP) was an expensive, complex ordeal, costing thousands and demanding technical expertise—barriers that kept creative and grassroots players on the sidelines.

The cast: three Gen Z founders—CEO Noah Tweedale (21), CTO Dylan Kerler (21), and COO (pseudonym) Alon Cohen (23). Spotting this roadblock, they set out to “solve meme coin rug pull risk,” dreaming of creating “the most interesting place on the internet.”

Pump.fun debuted in January 2024, unleashing a real breakthrough: “one-click token launch.” What had taken days and dollars now took minutes and pocket change. Disruptive? Absolutely. Growth was explosive.

But the innovation was quickly hijacked by speculators. The entire business model became a hype amplifier, and the $4 billion PUMP presale escalated speculation to a fever pitch.

The disregard for business rules was constant. They won trust with anti-presale rhetoric—then pulled off the largest presale yet. Under FCA scrutiny, they cut ties with the UK entity; the CEO denied Pump.fun was a UK company, the COO insisted that employment didn’t imply ownership. For many, it all looked calculated—not naïve.

Technical prodigies, speculators, and rule-benders—together, they wrote Pump.fun’s story of a meteoric rise and a dramatic fall. The young founders never imagined that a project designed for fun would cast them into a legal and commercial storm.

At a Crossroads

Pump.fun now stands at the crossroads. Pending litigation, collapsing market share, and lost user trust have halted its momentum.

This is a harsh lesson in DeFi Darwinism: a platform thrives on adaptability (low barriers, viral spread), but without evolving to survive complexity (regulation, trust, security), extinction looms.

Pump.fun’s crisis challenges the entire crypto industry: when innovation pushes the edge of legality, to what extent should platforms be liable for what happens on their turf?

As regulators home in on DeFi instead of just centralized exchanges, the next Pump.fun is surely waiting in the wings.

For every market participant, the need to tell fun from a scam is more critical than ever. This tale—from grassroots ascent to peak hype and back down—may set the stage for crypto’s next chapter.

Disclaimer:

- This article is republished from [ChainCatcher]. Copyright belongs to the original author [Zz, ChainCatcher]. For republication concerns, please contact the Gate Learn Team, who will respond to requests in accordance with our policy.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team. Without a reference to Gate, reproduction, distribution, or copying of the translated article is prohibited.