Hackers actually caused the growth of SUI ecosystem? Only one step away from the historical high

On July 28, SUI broke above $4.44, hitting its highest price since January. The SUI token has gained more than 53% over the past month, posting four consecutive days of gains since July 24 and four consecutive weeks of gains since June 23. SUI’s current total market capitalization stands at $14.7 billion, ranking 11th overall, while its fully diluted valuation (FDV) has climbed to $43.048 billion. These impressive returns for a large-cap protocol token have attracted significant attention from investors.

How has the Sui ecosystem rebounded since its setback in May? And what factors are fueling SUI’s powerful rally?

Sui Bounces Back from Cetus Hack

On May 22, Cetus—the largest DEX aggregator on Sui—suffered a major security breach that drained approximately $223 million USD from its liquidity pools. Attackers exploited fake tokens to manipulate the pools and inflict heavy losses. However, rapid intervention from the Sui community and development team turned the situation around. Cetus halted trading and launched a recovery plan, ultimately retrieving 85% to 99% of the lost funds. About $162 million in frozen assets was released after a community vote, though this centralized freeze sparked heated debate. Cetus relaunched in June and now plans to go fully open source to boost transparency and security.

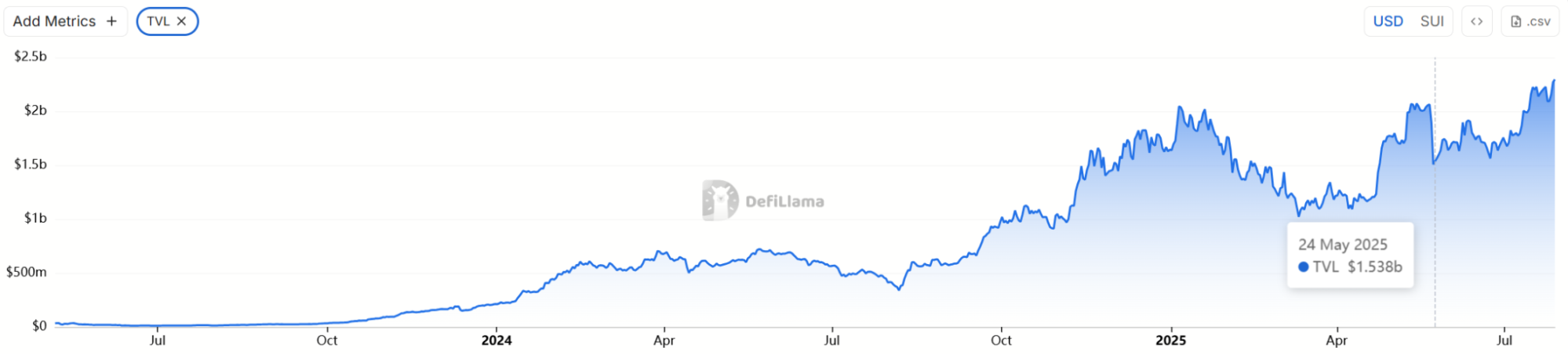

DeFiLlama data shows that after the hack, Sui’s total TVL dropped to $1.538 billion. As of now, total TVL has rebounded to $2.296 billion, setting a new all-time high.

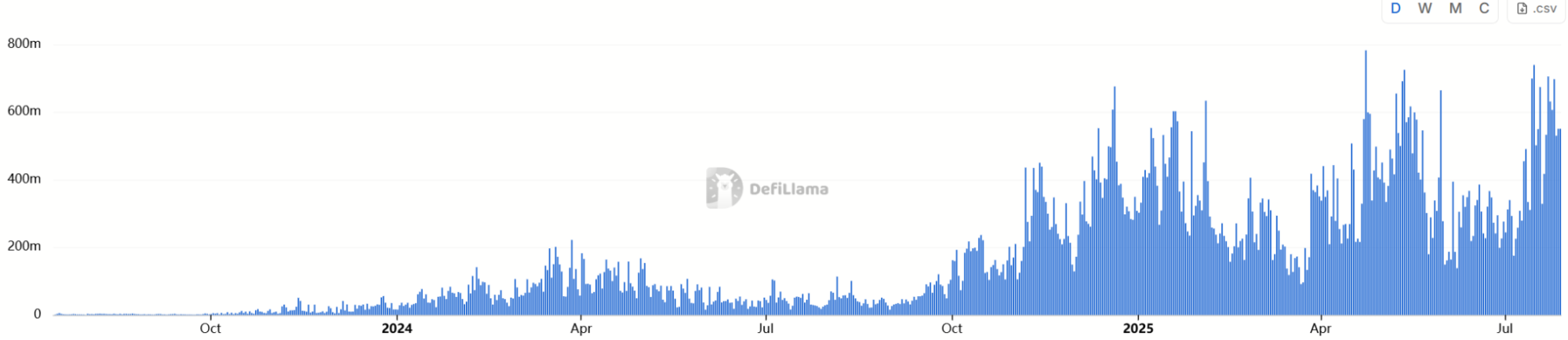

DEX trading activity has also steadily recovered since June, with Sui’s DEX trading volume surpassing $550 million in the past 24 hours and up more than 8.79% for the week.

Within the ecosystem, Cetus alone recorded $225.28 million in trading volume over the past 24 hours—about half of Sui’s entire DEX volume—demonstrating a rapid recovery.

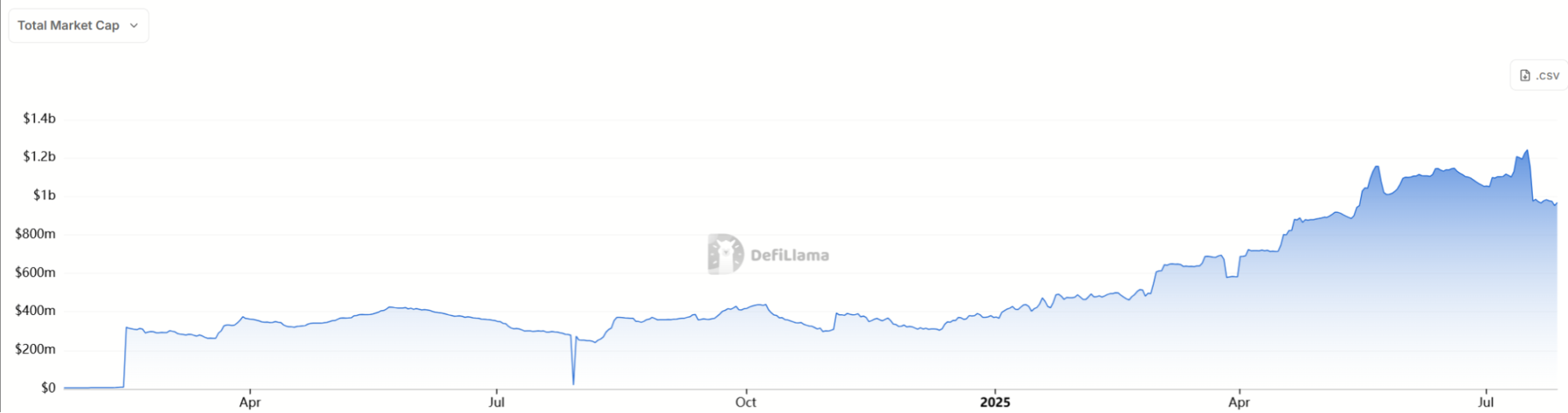

On the stablecoin front, Sui’s total stablecoin market cap stands at $968.38 million. While it has pulled back slightly over the past week, it remains at historically high levels. Notably, USDT inflows increased by 21% in the last 24 hours.

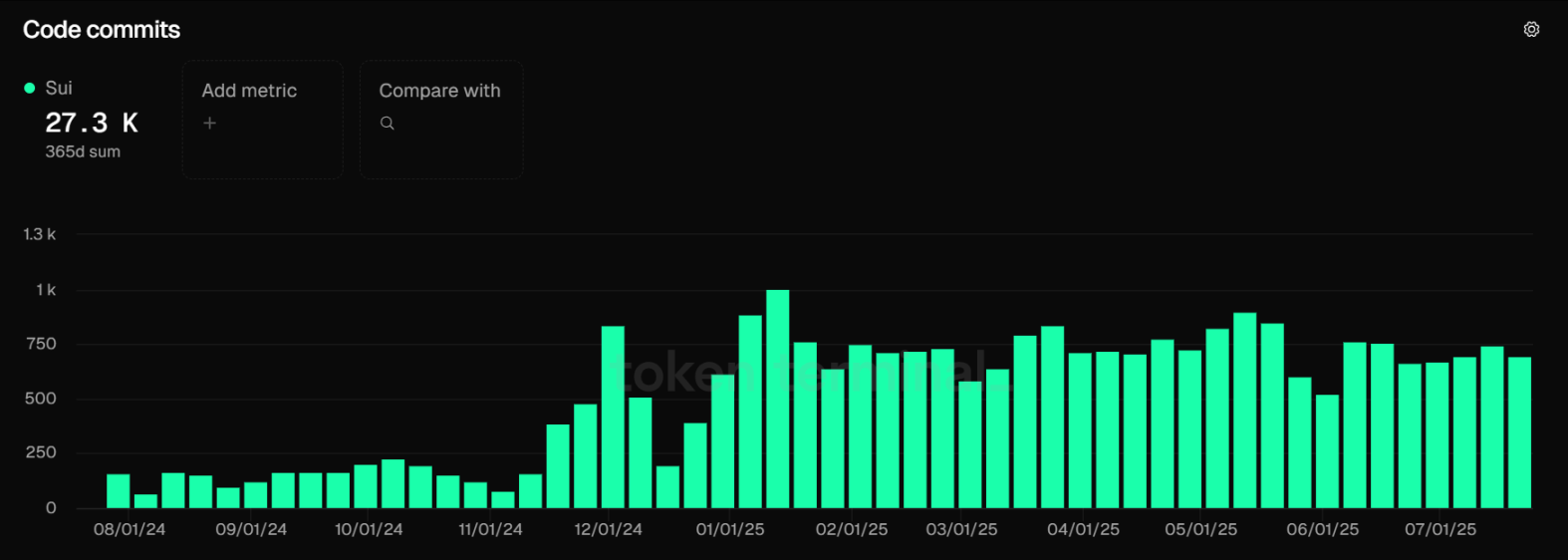

Code commits—the number of updates to a project’s public GitHub repository—reflect development activity. Terminal data shows that after a brief dip in late May and early June, Sui’s code commits rapidly bounced back to prior highs.

The data shows that the Cetus hack not only failed to derail SUI but also accelerated the project’s maturation.

Nasdaq-listed Lion Purchases Over 1 Million SUI Tokens

Using cash reserves to buy crypto has become a trend among US public companies. Following Strategy’s lucrative BTC bet—which inspired widespread emulation—firms have also begun holding ETH, SOL, ENA, and more.

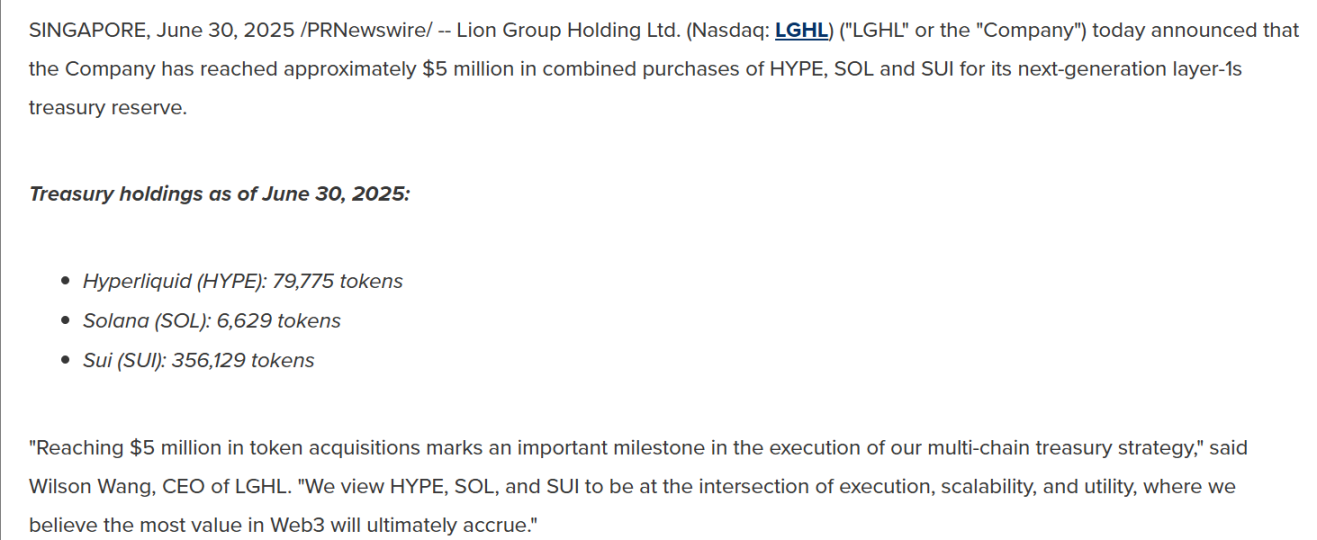

In June 2025, Nasdaq-listed Lion Group Holding Ltd. (LGHL) purchased SUI, SOL, and HYPE, raising its crypto holdings to $9.6 million. Lion Group acquired 356,129 SUI tokens, according to disclosures.

As a micro-cap stock worth just a few million dollars, Lion’s move is small in scale but carries outsized symbolic weight.

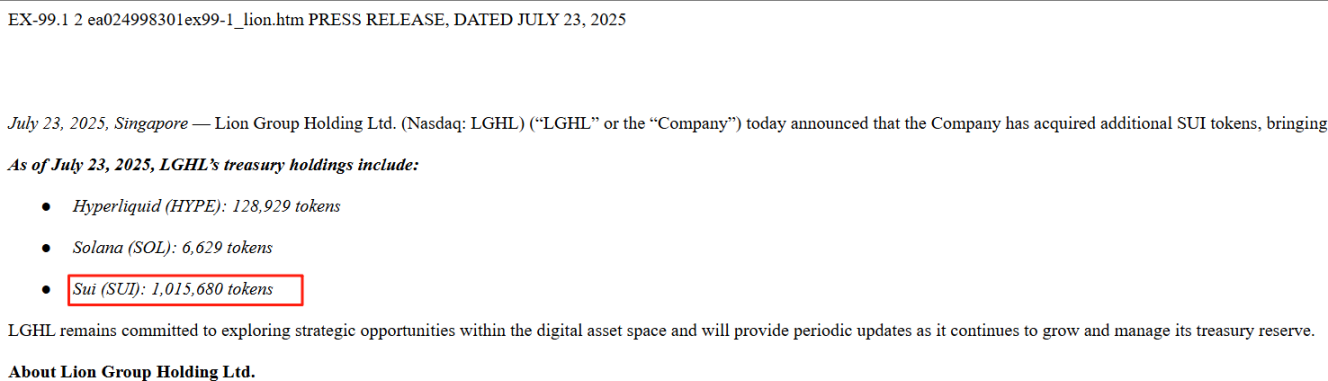

On July 24, SEC filings revealed that Lion Group increased its SUI holdings to 1,015,680 tokens. At the current price of $4.25 per SUI, that’s about $4.32 million in value.

Previously, US-listed Everything Blockchain Inc. (EBZT) announced plans to invest $10 million across five blockchains: Solana (SOL), XRP, Sui (SUI), Bittensor (TAO), and Hyperliquid (HYPE).

As crypto assets integrate further into mainstream finance, SUI’s Layer 1 positioning attracts growth-driven public companies. If more companies follow, SUI’s liquidity and price stability will likely increase further.

SUI spot ETF approval on the horizon?

The prospect of a SUI ETF approval is a major milestone for crypto mainstreaming. The US SEC has officially started reviewing Canary Capital’s SUI spot ETF application (filed in March 2025; the SEC extended the review period in June, up to 240 days). 21Shares’ SUI ETF is in a similar review process, with Nasdaq’s 19b-4 filing entering review in June.

If a SUI spot ETF is approved, inflow data from Bitcoin and Ethereum ETFs suggests it could meaningfully boost market confidence and drive SUI’s price higher.

In June, Bloomberg Senior ETF Analyst Eric Balchunas estimated the probability of SUI ETF approval at 60%.

Earlier this year, asset manager VanEck forecast SUI could achieve a 5.5% market share and a $61 billion market cap. With 3 billion tokens circulating, the price per SUI could reach $16. Just yesterday, Twitter influencer 0x0xFeng tweeted, “SUI should be breaking new highs.”

In this altcoin bull run, SUI could continue to be a market leader.

Disclaimer:

- This article is republished from [Foresight News], with copyright held by the original author [1912212.eth, Foresight News]. If you have any concerns about this republication, please contact the Gate Learn team. The team will address your concern promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author only and do not constitute investment advice of any kind.

- Other language versions of this article are translated by the Gate Learn team. Do not reproduce, distribute, or plagiarize the translated material unless Gate is clearly referenced.