Fed Decision Preview: How will US interest rates affect the stablecoin industry?

The stablecoin market has seen a continuous surge in size and importance, driven by sustained crypto market momentum and the expansion of mainstream use cases. As of mid-2025, total market capitalization has surpassed $250 billion, up more than 22% from the start of the year. According to Morgan Stanley, these dollar-pegged tokens now generate average daily volumes exceeding $100 billion and drove $27.6 trillion in on-chain transaction volume in 2024. Nasdaq data shows this now outpaces the combined totals of Visa and Mastercard. However, significant risks remain—most notably, the fact that stablecoin issuers’ business models and token stability are tightly linked to shifts in U.S. interest rates. With the next Federal Open Market Committee (FOMC) decision on the horizon, this study uses a global lens to analyze how the Fed’s interest rate cycle and other major risks could reshape the landscape for fiat-backed USD stablecoins like USDT and USDC.

Stablecoins 101: Navigating Growth Amid Hype and Regulation

Stablecoin Definition:

Stablecoins are crypto assets engineered to maintain a constant value, typically pegged 1:1 to the U.S. dollar. Stability is ensured either by full-reserve backing (such as cash and short-term securities) or by algorithmic supply controls. Leading fiat-backed stablecoins like Tether (USDT) and Circle (USDC) fully collateralize every issued token with cash and short-term securities—the core mechanism for price stability. Data from the Atlantic Council shows that about 99% of circulating stablecoins are USD-denominated.

Industry Relevance and Status:

By 2025, stablecoins are increasingly being adopted in mainstream finance and commerce. Visa has rolled out a platform for bank-issued stablecoins, Stripe has integrated stablecoin payments, and Amazon and Walmart are exploring their own stablecoin initiatives. Meanwhile, regulatory frameworks are rapidly maturing worldwide. In June 2025, the U.S. Senate passed the landmark Stablecoin Payment Clarity Act (GENIUS Act)—the first federal law regulating stablecoins. Key requirements: issuers must maintain a stable 1:1 backing ratio using high-quality liquid assets (cash or short-term Treasuries maturing within three months), and clearly define token holder rights and protections. In Europe, the Markets in Crypto-Assets (MiCA) regulation enforces even stricter rules, giving authorities the power to curb non-euro stablecoin circulation if eurozone stability is threatened. The total stablecoin circulation exceeded $255 billion as of June 2025. Citi projects the market could reach $1.6 trillion by 2030—a nearly sevenfold jump. The adoption of stablecoins in mainstream markets is evident, but rapid growth brings new risks and friction.

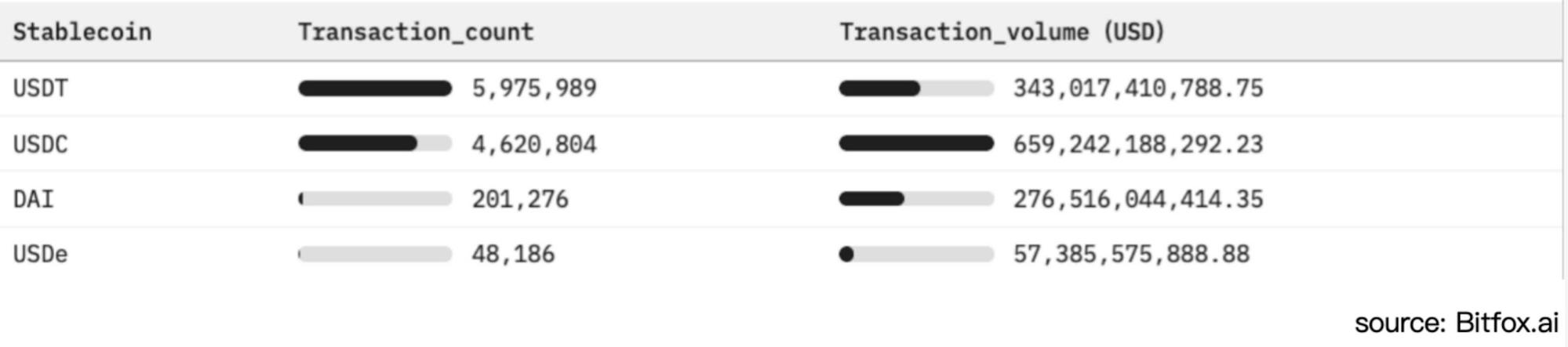

Figure 1: Comparison of Ethereum Stablecoin Adoption and Market Activity (Past 30 Days)

Fiat-Backed Stablecoins and Their Sensitivity to Interest Rates

Unlike traditional bank deposits that pay interest, stablecoin holders generally receive no yield. Under the Stablecoin Payment Clarity Act (GENIUS Act), fiat-collateralized USD stablecoin user accounts are explicitly set at a 0% interest rate. This allows issuers to capture all income from investing reserves. In today’s high-interest rate environment, this has enabled companies like Tether (USDT) and Circle (USDC) to achieve substantial profitability. Yet, this model exposes issuers to significant risk if interest rates fall.

Reserve Investment Structure:

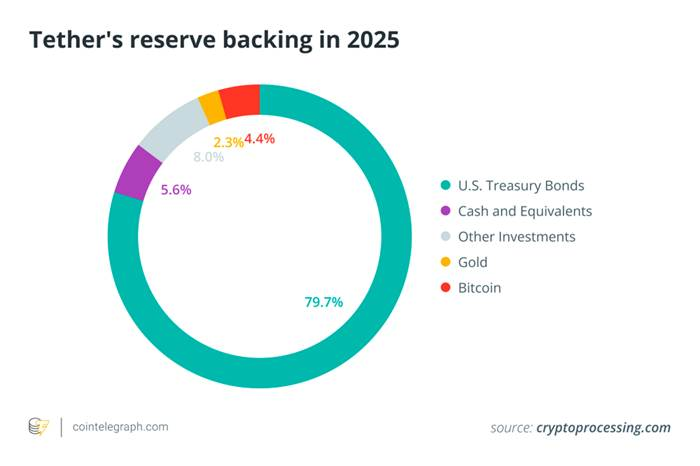

To ensure liquidity and maintain the peg, major issuers concentrate reserves in short-term U.S. Treasuries and other short-term instruments. By early 2025, Tether held between $113 billion and $120 billion in U.S. government debt—roughly 80% of its total reserves—making it one of the world’s top 20 holders of Treasuries. The chart below breaks down Tether’s reserves, highlighting the heavy reliance on Treasuries and cash; other securities, gold, and Bitcoin make up a much smaller portion.

Figure 2. Tether’s Reserve Composition in 2025 (primarily U.S. Treasuries), illustrating fiat-backed stablecoins’ heavy dependency on interest-bearing government securities.

High-quality reserves not only help maintain the peg and reinforce user trust—they’re also the foundation for substantial interest income, which underpins the stablecoin business model. The Fed’s aggressive rate hikes from 2022–2023 sent T-bill and deposit yields to multi-year highs, significantly boosting stablecoin reserve returns. For instance, Circle’s 2024 financials show that $1.67 billion of its $1.68 billion in total revenue (99%) was from interest on reserves. Techxplore reports that Tether’s 2024 profit hit $13 billion—comparable to or exceeding those of major US financial institutions such as Goldman Sachs. For a company with about 100 employees, this indicates that high interest rates are a primary driver of stablecoin issuer profits. In essence, issuers are engaging in a high-yield spread strategy: using customer funds to buy Treasuries yielding more than 5%, while retaining the entire spread because users earn no yield. This leaves stablecoins highly exposed to interest rate swings.

Interest Rate Risk Exposure

Stablecoin issuers’ revenues are exceptionally exposed to Fed policy shifts. For example, a 50-basis-point cut (0.50%) could reduce Tether’s annual interest income by about $600 million. Nasdaq analysts caution: “Overreliance on interest income will leave issuers like Circle vulnerable in cutting cycles.”

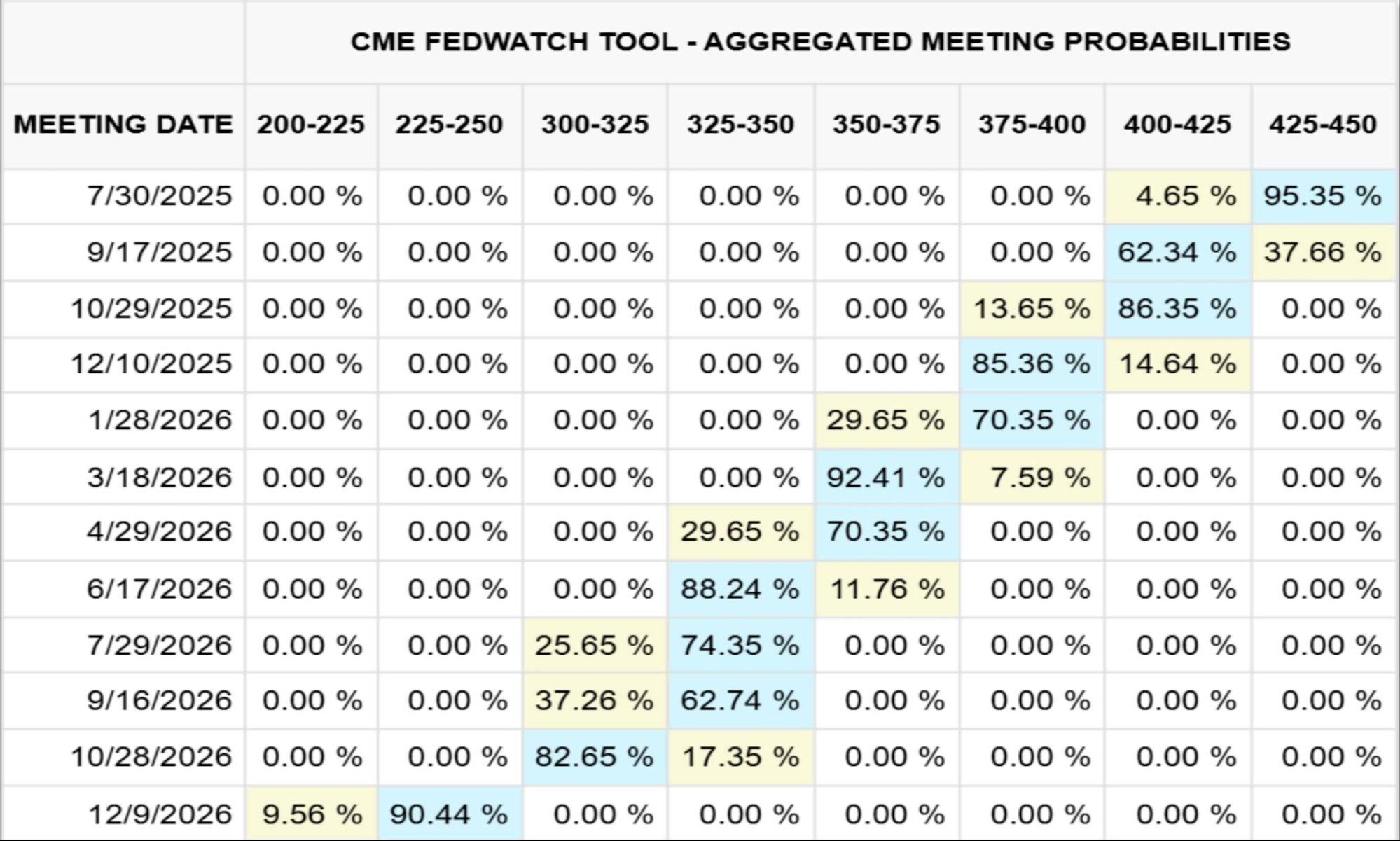

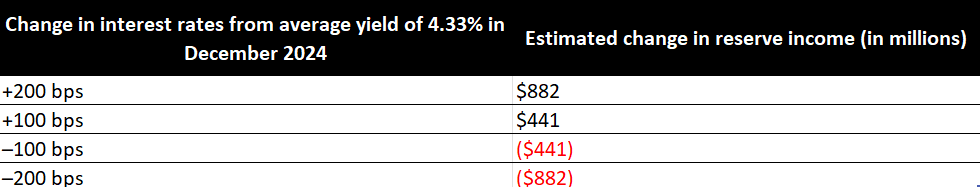

Figure 3 below charts the CME’s federal funds rate outlook (as of July 23, 2025) projecting through end-2026; Figure 4 quantifies, in millions, the impact of rate moves on Circle’s reserve income.

Figure 3. Federal Funds Rate Outlook, December 2026 (CME, 2025/07/23)

Figure 4. Sensitivity of Circle’s Reserve Income to Interest Rate Changes

For example, in 2024, Circle earned $1.67 billion in interest on reserves—99% of its $1.68 billion in total revenue. According to the CME model (as of July 23, 2025), if the federal funds rate drops to 2.25%–2.50% by December 2026 (about a 90% probability), Circle stands to lose around $882 million—over half its 2024 interest income. To bridge this gap, the company would need to double USDC’s circulating supply by year-end 2026.

Risks Beyond Rates: The Multifaceted Challenges Facing Stablecoins

While interest rate dynamics are a central driver, the stablecoin ecosystem faces several other critical risks and challenges. A clear, objective assessment requires systematically outlining these:

Regulatory and Legal Uncertainty

Stablecoins operate under fragmented frameworks such as the U.S. Stablecoin Payment Clarity Act (GENIUS Act) and the EU’s MiCA regulation. Although these laws legitimize some issuers, they also impose high compliance costs and the potential for sudden market access blocks. Regulatory enforcement—triggered by issues like inadequate reserve transparency, sanctions evasion (as with Tether’s multi-billion-dollar transactions in sanctioned regions), or consumer harm—can lead to frozen redemptions or ejection from key markets.

Banking and Liquidity Concentration Risk

Fiat-backed stablecoins rely heavily on a small number of partner banks for reserve custody and fiat on/off-ramp services. Bank failures (as with Silicon Valley Bank, which froze $3.3 billion in USDC reserves) or mass redemptions can quickly drain bank deposits, cause de-pegging, and—under large-scale redemption pressure—threaten the broader banking system’s liquidity.

Peg Stability and De-Peg Risk

Even fully collateralized stablecoins can lose their peg when market confidence falters, as in March 2023, when USDC dropped to $0.88 due to worries about reserve access. Algorithmic stablecoins are even riskier, as seen with TerraUSD’s (UST) collapse in 2022.

Transparency and Counterparty Risk

Users depend on attestation reports (typically quarterly) from issuers to assess asset quality and liquidity, but without full public audits, trust remains fragile. Whether reserves are held as bank deposits, money market fund shares, or in repurchase agreements, counterparty and credit risk could undermine redemption guarantees in times of stress.

Operational and Technical Security Risks

Centralized stablecoins can freeze or confiscate tokens to counter threats but introduce single-point-of-failure risks. DeFi versions are vulnerable to smart contract bugs, cross-chain bridge hacks, or custodian breaches. User mistakes, phishing scams, and the irreversible nature of blockchain transactions also pose everyday security challenges for holders.

Macro-Financial Stability Risk

With hundreds of billions in reserves concentrated in short-term Treasuries, large-scale stablecoin redemptions could directly impact Treasury demand and increase yield volatility. In extreme scenarios, this could trigger forced asset sales in the Treasury market. Wide-scale stablecoin use could also weaken the Fed’s monetary policy transmission. This could potentially hasten development of a U.S. central bank digital currency (CBDC) or new regulations.

Conclusion

As the next FOMC meeting nears, markets expect rates to hold steady, but market participants will closely scrutinize the details in meeting minutes and guidance. The impressive growth of fiat-backed stablecoins like USDT and USDC masks a business model fundamentally tied to U.S. interest rate cycles. Even a modest rate cut (25–50 basis points) could wipe out hundreds of millions in annual profits, forcing issuers to rethink growth strategies or pass on more yield to token holders to maintain adoption.

Beyond rate risks, stablecoins must confront an ever-shifting regulatory landscape, banking and liquidity concentration risk, peg integrity challenges, and operational hazards. These range from smart contract bugs to lack of reserve transparency. Most crucially, as these tokens become major holders of short-term Treasuries, redemption flows could disrupt global bond pricing and undermine the monetary transmission mechanism.

Disclaimer:

- This article is republished from [TechFlow] and copyright remains with the original authors [0xYYcn Yiran, Bitfox Research]. If you have concerns about this republication, please contact the Gate Learn Team, and the team will respond promptly according to relevant procedures.

- Disclaimer: The views and opinions presented are those of the authors and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Translated articles may not be copied, distributed, or plagiarized without explicit mention of Gate.com.