LTC Takes Wall Street: MEI Pharma’s “Litecoin Treasury” Soars Over 80%

On July 19, MEI Pharma (NASDAQ: MEIP), a U.S. pharmaceutical company, announced a major strategic pivot, launching a dedicated Litecoin treasury initiative that has already secured more than $100 million in committed capital.

As part of this transaction, the biotech firm will appoint Litecoin founder Charlie Lee to its board of directors. GSR will also join the board and assume a prominent role on MEI’s Digital Asset and Treasury Management Advisory Committee. The Litecoin Foundation has likewise invested in MEI Pharma, citing strong alignment between MEI’s treasury strategy and the Foundation’s mission to drive global adoption of Litecoin.

The news sent MEIP shares soaring 83.37% in Friday’s pre-market trading, building on a 16.58% rally the previous day. The stock peaked at $9 before settling at $6.30. Trading volume topped 13 million shares—significantly exceeding the three-month daily average of 26,000 shares. This dramatic surge signals bullish sentiment for MEI’s blockchain transformation and ushers in a new “altcoin microstrategy” trend for institutional portfolios. Following the adoption of mainstays like ETH, SOL, and BNB, Litecoin (LTC) marks a new chapter in asset allocation.

MEI Pharma Completes Strategic Transformation: First Public Company to Build a Litecoin Strategic Reserve

MEI Pharma, Inc. is a biopharmaceutical company specializing in small molecule drug development. Its core R&D portfolio includes Voruciclib, a CDK inhibitor targeting B-cell malignancies, and ME-344, a mitochondria-targeting anti-cancer candidate. Founded December 1, 2000, the company is headquartered in San Diego, California.

On July 19, 2025, MEI Pharma announced its entry into blockchain finance, launching a new PIPE round and unveiling plans to allocate Litecoin (LTC) to its corporate treasury—making it the first publicly traded biotech to designate LTC as a primary reserve asset.

According to the announcement, this round is co-led by Titan Partners Group and crypto trading firm GSR. MEI will issue 29,239,767 shares of common stock or equivalent prepaid warrants at $3.42 per share, raising approximately $100 million. The transaction is expected to close around July 22, 2025, subject to standard regulatory approvals and customary closing conditions.

Beyond a capital raise, this move signals a profound strategic transformation. MEI reports it has rigorously assessed the traditional biotech business model’s sustainability and now aims to embrace blockchain and DeFi. The company plans to restructure its treasury around Litecoin and develop long-term partnerships with the Litecoin Foundation and GSR.

Charlie Lee commented on the partnership: “Since 2011, Litecoin has championed speed, security, and decentralization. It’s exciting to see a public company like MEI adopt these principles. This growing institutional confidence in LTC paves the way for its broader expansion into traditional capital markets.”

Why Litecoin?

Litecoin is one of the earliest altcoins, launched in 2011 by former Google engineer Charlie Lee. Built on Bitcoin’s open-source code with key optimizations, Litecoin features faster block times and utilizes the Scrypt proof-of-work algorithm, enabling mining with standard hardware and lowering barriers to entry. It has a fixed supply of 84 million coins, and like Bitcoin, features a deflationary model—block rewards halve every 840,000 blocks.

As a pioneering altcoin, Litecoin has consistently prioritized on-chain efficiency and scalability. It provides low transaction fees and rapid settlement. In recent years, Litecoin’s payment ecosystem has expanded to include travel agencies, convenience stores, real estate, and online retailers. In 2021, the Litecoin Foundation partnered with financial providers to launch a Visa debit card, letting users instantly convert LTC to USD for purchases—further solidifying its role as a practical digital asset.

Since launching Litecoin in 2011, Charlie Lee has remained the driving force behind its ongoing development. He has led major upgrades—including selective privacy features and Segregated Witness integration—and has championed the Lightning Network, mining pool collaboration, and developer community building, cementing the long-term viability of both the Litecoin and Bitcoin networks.

Lee’s direct engagement with MEI Pharma’s Litecoin treasury strategy has renewed market confidence in the concept. As the Litecoin Foundation noted: “For 14 years, Litecoin has provided millions with a stable, low-cost, and accessible network.” This partnership with MEI not only marks Litecoin’s first inclusion in a US-listed company’s balance sheet, but also represents a strategic institutional experiment—driven by its founder.

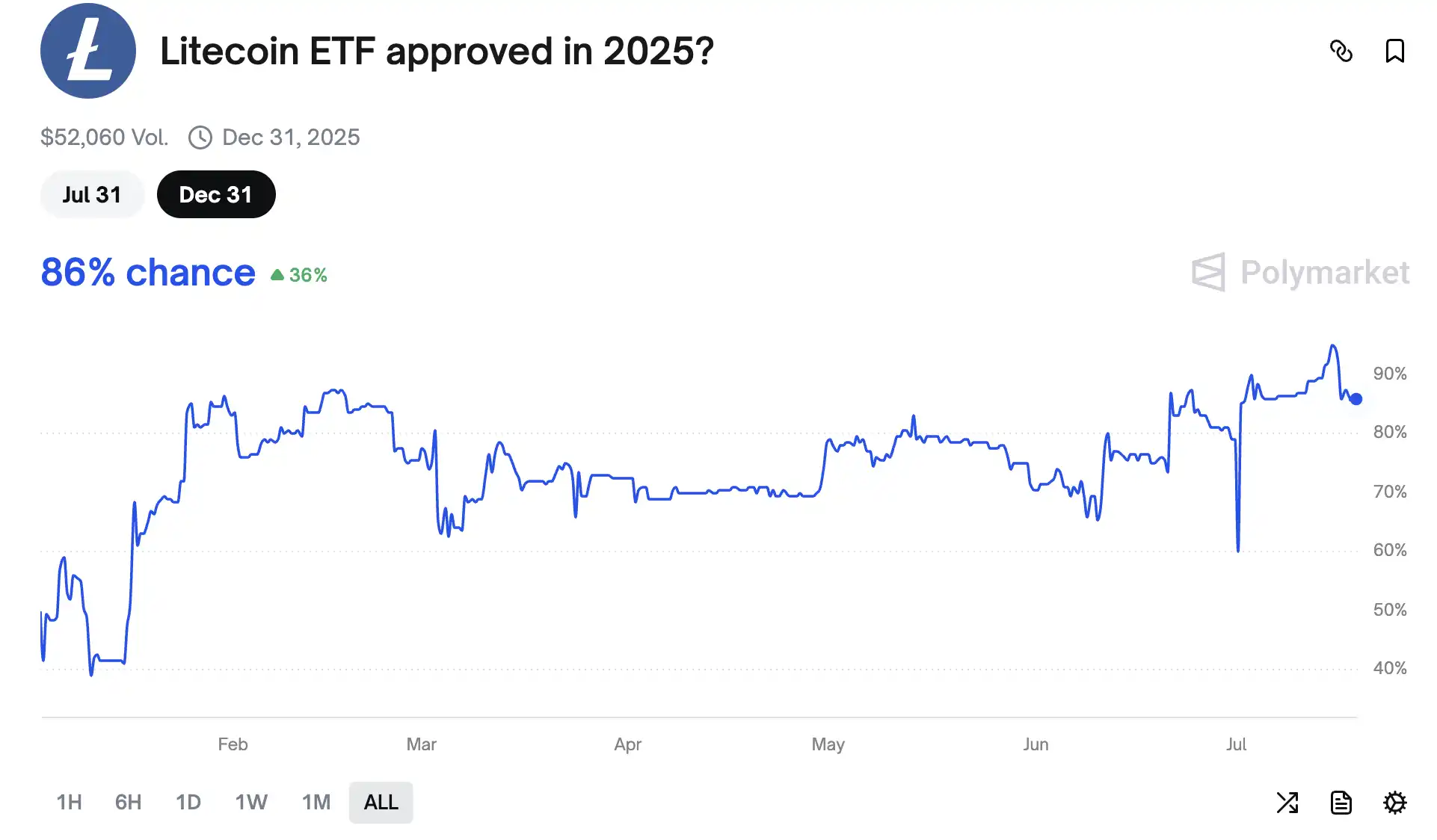

Institutional momentum for Litecoin continues to accelerate. According to decentralized prediction platform Polymarket, as of late 2025, the chance of SEC approval for a Litecoin spot ETF has soared to 86%. This highlights investor optimism about Litecoin’s regulatory outlook and signals its progress toward mainstream asset status amid increasing compliance.

Should a spot ETF gain approval, Litecoin—alongside Bitcoin and Ethereum—will become a core holding for traditional portfolios, offering regulated options for institutional allocation. A spot ETF approval would boost LTC’s liquidity and valuation, strengthen its position as a payments-focused digital asset, and bridge blockchain with traditional capital markets.

Conclusion

MEI Pharma’s inclusion of LTC as a treasury asset marks it as the first public company to do so, following Ethereum, BNB, and SOL in the “microstrategy” trend. The announcement triggered a breakout for Litecoin—surging over 6% within 24 hours, climbing from $106 to $115. This underscores a reassessment of LTC’s asset status and further cements the “altcoin microstrategy” as a core growth driver in the current bull market. ETF excitement and rapid institutional accumulation are fueling the momentum of “altcoin season.”

Disclaimer:

- This article is reposted from BLOCKBEATS. Copyright remains with the original author kkk. For republication concerns, please contact the Gate Learn team for assistance.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- The Gate Learn team translated other language versions. Republishing, distributing, or copying translated articles is prohibited unless proper credit is given to Gate.