Is this company the real stablecoin unicorn?

On the evening of July 21, Ethena’s native token ENA spiked 20% to reach $0.59—its highest level in six months—after reports that a treasury entity planned to acquire $260 million in ENA tokens. The news set off a flurry of market interest. This article explores the details behind the event and ENA’s recent performance. It also assesses its potential impact on the Ethena project and broader market, and provides an evaluation of the project’s current status.

StablecoinX Secures Funding and Pursues Nasdaq Listing

On July 21, Ethena announced that its StablecoinX subsidiary had entered into a merger agreement with TLGY Acquisition Corp, paving the way for a SPAC-backed public listing and an intended capital raise of roughly $360 million. The Ethena Foundation committed $60 million, while other institutional investors include Dragonfly, Pantera Capital, Galaxy Digital, Wintermute, Polychain, and Haun Ventures, among others.

This financing round is being conducted via a PIPE (Private Investment in Public Equity), with $260 million contributed in cash and $100 million in discounted, locked-up ENA tokens. According to the official announcement, the capital will be used to build a long-term ENA treasury. StablecoinX aims to deploy about $5 million daily in open market ENA purchases, targeting an aggregate of approximately $260 million worth of ENA tokens over the next six weeks—representing around 8% of the current circulating supply.

StablecoinX’s strategy involves more than just investing in ENA—it plans to operate core technological infrastructure for the Ethena ecosystem, including validator nodes and staking services. Once the raise is complete, StablecoinX will list on Nasdaq under the ticker “USDE,” with the Ethena Foundation holding a majority voting stake.

The Ethena team stressed that these tokens will remain locked long-term and be held permanently, with the Foundation maintaining veto rights over any sales. The intent is to continually increase treasury ENA holdings to support the ecosystem and maximize per-share ENA value over time.

Recent ENA Price Performance Review

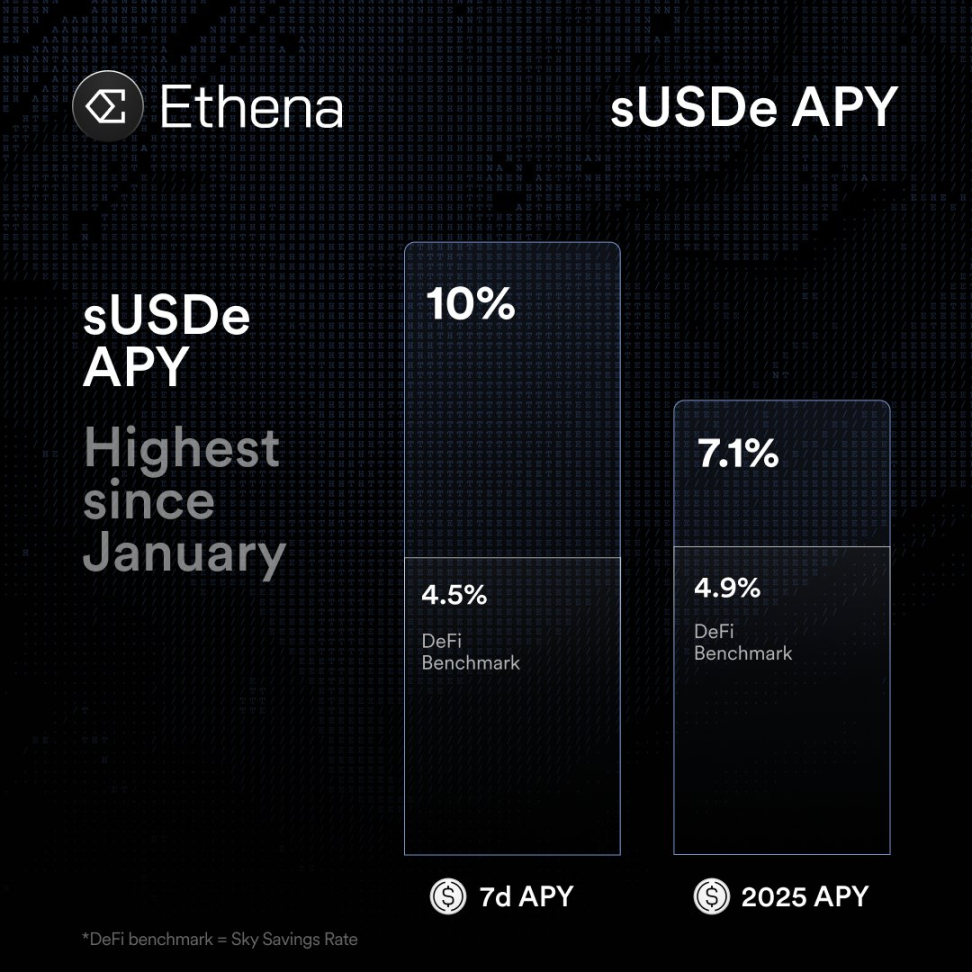

Before the StablecoinX news broke, ENA had already begun surging. On July 20, a broad market rally lifted funding rates across major assets like ETH and SOL, and previously stagnant Ethena tokens saw renewed capital inflows. ENA jumped 20% that day, breaking above $0.50 for the first time since February. Investors added about $750 million in net inflows to Ethena’s synthetic dollar stablecoin, USDe, that day, pushing the total supply close to an all-time high of $6.1 billion. During this period, Ethena’s arbitrage strategies became profitable, and sUSDe delivered an annualized yield of 10%, which far exceeded U.S. money market fund returns.

Potential Impact on the Ethena Project

The establishment and public listing plans for StablecoinX carry major significance for Ethena.

First, this represents another proactive effort by a DeFi project to access traditional capital markets, similar to Circle’s (USDC) direct listing and the launch of tradable products by Ripple. These moves reinforce that stablecoins are increasingly capturing institutional attention. Through the public company model, Ethena aims to offer traditional equity investors direct exposure to its growth narrative—a clear indication of convergence between stablecoins and traditional finance (TradFi). As Ethena’s founder noted, this transaction brings public market investors a pure “digital dollar” investment vehicle.

Second, from a capital flow perspective, StablecoinX’s aggressive and long-term ENA accumulation plan brings a powerful new buyer into the ecosystem. The strategy to purchase $5 million in ENA daily over several weeks—along with $360 million in total cash and locked tokens—will materially raise demand for ENA. This “Bitcoin treasury” approach (mirroring corporate BTC strategies like MicroStrategy’s) could provide long-lasting price support for ENA. Whether the project’s underlying fundamentals have shifted remains an open question.

Some market observers argue that this stable, institutional capital allocation can create real user demand and push up the token’s long-term price floor. Others point out, however, that such capital inflows do not directly change Ethena’s core economics: The protocol still operates by having users mint USDe through crypto collateral to run hedged yield strategies. The StablecoinX purchase plan boosts market demand but does not alter how the Ethena protocol itself works—so whether the project’s underlying fundamentals have shifted remains an open question. Over the long term, this introduces a steady “ENA bull” to the cap table, but if the core arbitrage model faces challenges (such as declining funding rates), Ethena’s earning power will still face scrutiny.

Third, the broader regulatory landscape is shifting. The U.S. recently passed several major stablecoin regulations, including the GENIUS Act, which requires all stablecoins to be fully backed by assets (cash or Treasuries), imposes stricter oversight, and bans equity-like, yield-generating stablecoins. These moves show that U.S. regulators and TradFi are giving the stablecoin sector increased and sophisticated attention.

For Ethena, its USDe qualifies as a “crypto-collateralized synthetic dollar,” making compliance a potential challenge under new rules. Should Ethena seek full compliance with U.S. stablecoin law, its hedging strategies may require adjustments. Currently, though, Ethena’s team maintains that USDe isn’t a payment stablecoin, but rather a synthetic asset, so they believe it falls outside the new act’s direct scope. All in all, StablecoinX’s public listing and fundraising coincide with growing regulatory clarity, which could require Ethena to address additional compliance concerns while also raising its legitimacy and profile in established markets.

Ethena Project Status Assessment

Overall, Ethena is in a phase of rapid growth. The revival of funding rates has made USDe increasingly appealing. Recently, Ethena’s stablecoin strategies—using BTC, ETH, and SOL for hedging—have generated nearly 10% annualized returns for users, far exceeding those of traditional U.S. dollar funds. This has attracted significant capital, with net new USDe minting of about $750 million last week and total supply approaching historic highs.

Regulatory and policy trends are also worth watching. The U.S. has enacted the GENIUS stablecoin act, putting stablecoin issuance under Federal Reserve oversight and mandating full (100%) asset backing. This has had lasting effects on leading stablecoins like USDC and USDT. Ethena’s USDe, as a crypto-collateralized stablecoin, could require adjustment or special exemption under the new framework.

As noted, Ethena is in dialogue with regulators to have USDe classified as a synthetic dollar, thereby avoiding direct regulation under the new act. However, if Ethena plans to offer USDe to U.S. investors in the future, it may need to add more fiat or Treasury reserves. In short, regulatory uncertainty presents challenges—particularly concerning the regulatory compliance of Ethena’s high-yield model.

The project also made progress in bridging to traditional assets. Ethena introduced USDtb, a stablecoin backed by fiat or institutional assets, and deployed capital in BlackRock-managed U.S. dollar funds. These initiatives strengthen product compliance and institutional credibility. Ethena has also integrated with Telegram Wallet and launched lending strategies, increasing user engagement within its ecosystem. Still, as a relatively young DeFi protocol, Ethena must navigate compliance, competition, and market volatility to achieve sustained and stable growth.

In summary, StablecoinX’s successful fundraising and launch of the ENA treasury strategy have provided a near-term boost for Ethena—driving up token prices and investor confidence. In the long run, Ethena’s efforts to connect its digital dollar narrative with traditional capital markets could unlock new channels for capital and token distribution. However, this move does not fundamentally alter Ethena’s core collateralized hedging model.

Therefore, it’s too early to call this a fundamental change. Capital inflows and a public listing via StablecoinX are clear positives, but Ethena’s ability to sustain its high-yield mechanics and react to shifting regulations still needs to be proven over time.

Disclaimer:

- This article is republished from Foresight News. Copyright belongs to the original author Alex Liu, Foresight News. If you have any concerns regarding this republication, please contact the Gate Learn team and we will review your request according to our standard procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- The Gate Learn team translated this article into other languages. Do not reproduce, distribute, or use the translated content without properly attributing Gate.