- Topic1/3

38k Popularity

20k Popularity

3k Popularity

25k Popularity

17k Popularity

- Pin

- 📢 #Gate Square Writing Contest Phase 3# is officially kicks off!

🎮 This round focuses on: Yooldo Games (ESPORTS)

✍️ Share your unique insights and join promotional interactions. To be eligible for any reward, you must also participate in Gate’s Phase 286 Launchpool, CandyDrop, or Alpha activities!

💡 Content creation + airdrop participation = double points. You could be the grand prize winner!

💰Total prize pool: 4,464 $ESPORTS

🏆 First Prize (1 winner): 964 tokens

🥈 Second Prize (5 winners): 400 tokens each

🥉 Third Prize (10 winners): 150 tokens each

🚀 How to participate:

1️⃣ Publish an

- 📢 Gate Square #TopContentChallenge# is coming! Post high-quality content and win exclusive rewards!

🌟 We will select outstanding posts for exposure, and help elevate your influence!

💡 How to Participate?

1.Add the #TopContentChallenge# tag to your post.

2.Posts must be over 60 characters and receive at least 3 interactions (Likes/Comment/Share).

3.Post may include only the #TopContentChallenge# tag.

🎁 We’ll select 1 top post to win $50 Futures Voucher every Tuesday and Thursday!

📃 High-quality posts will be shared on Gate Square and labeled as [Featured Posts]!

📌 Rewards will be distribu

- 🎉 [Gate 30 Million Milestone] Share Your Gate Moment & Win Exclusive Gifts!

Gate has surpassed 30M users worldwide — not just a number, but a journey we've built together.

Remember the thrill of opening your first account, or the Gate merch that’s been part of your daily life?

📸 Join the #MyGateMoment# campaign!

Share your story on Gate Square, and embrace the next 30 million together!

✅ How to Participate:

1️⃣ Post a photo or video with Gate elements

2️⃣ Add #MyGateMoment# and share your story, wishes, or thoughts

3️⃣ Share your post on Twitter (X) — top 10 views will get extra rewards!

👉

[U.S. Stocks: Stock Discovery] 5 Stocks with Earnings Surprises: Micron Technology, AI Data Center Business is Rapidly Growing | U.S. Stocks, Industry Trends and Stock Analysis | Moneyクリ MoneyX Securities' Investment Information and Media Useful for Money

Micron Technology [MU] sees strong performance in HBM for generative AI data centers

The weight of high bandwidth memory (HBM), which has improved accuracy over conventional DRAM, is increasing.

Micron Technology, a major semiconductor memory company, announced that its financial results for the March-May 2025 period showed a revenue increase of 37% year-on-year, reaching $9.31 billion, and a net profit that rose 5.7 times to $1.885 billion. The non-GAAP (Generally Accepted Accounting Principles) EPS (earnings per share) was $1.91, exceeding the market estimate of $1.60 compiled by LSEG (London Stock Exchange Group) by 19.3%.

The demand for DRAM used in data centers for generative artificial intelligence (AI) continues to expand, leading to strong performance. As sales revenue increases, the gross profit margin has risen from 26.9% in the same period last year to 37.7%. The proportion of high bandwidth memory (HBM), which significantly improves data transfer speeds compared to conventional DRAM, has increased, resulting in improved profit margins.

The DRAM business is driving the overall performance, focusing on the data center business.

Sales by segment showed that the DRAM business, including HBM, increased by 50.7% year-on-year to $7.071 billion, driving the overall growth. The NAND flash memory business, which retains memory even when powered off, steadily grew by 4.4% to $2.155 billion.

In terms of segments, the Computer & Networking Business Unit (CNBU), primarily focused on data centers, is experiencing growth, with revenue increasing by 97% to $5.069 billion and operating profit surging 4.9 times to $2.182 billion. The storage segment, which includes solid-state drives (SSDs) utilizing NAND flash memory, secured a revenue increase of 7% to $1.451 billion, but has fallen into a slight operating loss.

Both the mobile division and the embedded division have seen a slight decrease in profits, and operating income has also declined for both. It can be said that the current focus is on the data center business.

Sanjay Mehrotra, the CEO, explained that "we are on track to achieve record-high sales in the fiscal year 2025 (ending in August)" and stated, "we are making disciplined investments aimed at establishing technological leadership and manufacturing excellence to respond to the growth in demand for AI-driven memory products."

In the guidance during the earnings announcement, sales revenue for the period from June to August 2025 is expected to be between $10.4 billion and $11 billion, with a gross profit margin of 40.0% to 42.0%, and EPS projected to be between $2.14 and $2.44. On a non-GAAP basis, sales revenue is forecasted to be between $10.4 billion and $11 billion, with a gross profit margin of 41.0% to 43.0%, and EPS expected to be between $2.35 and $2.65.

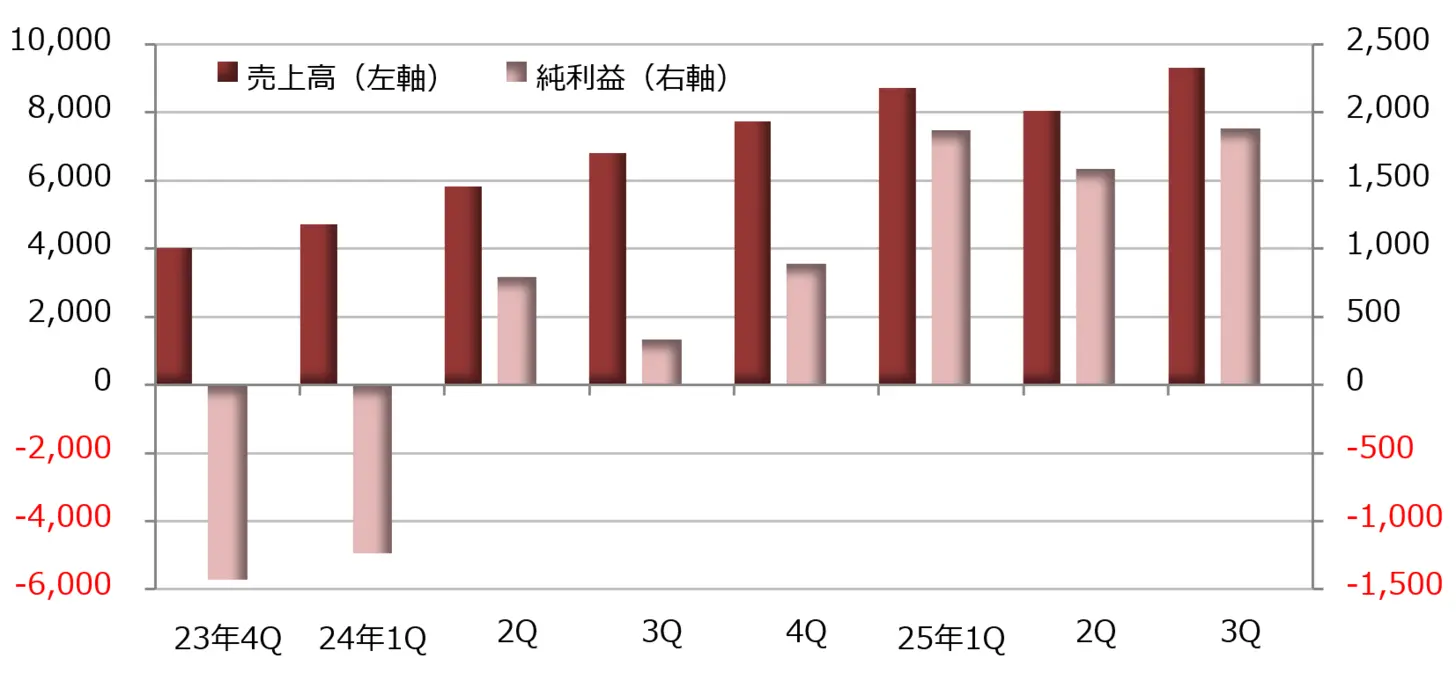

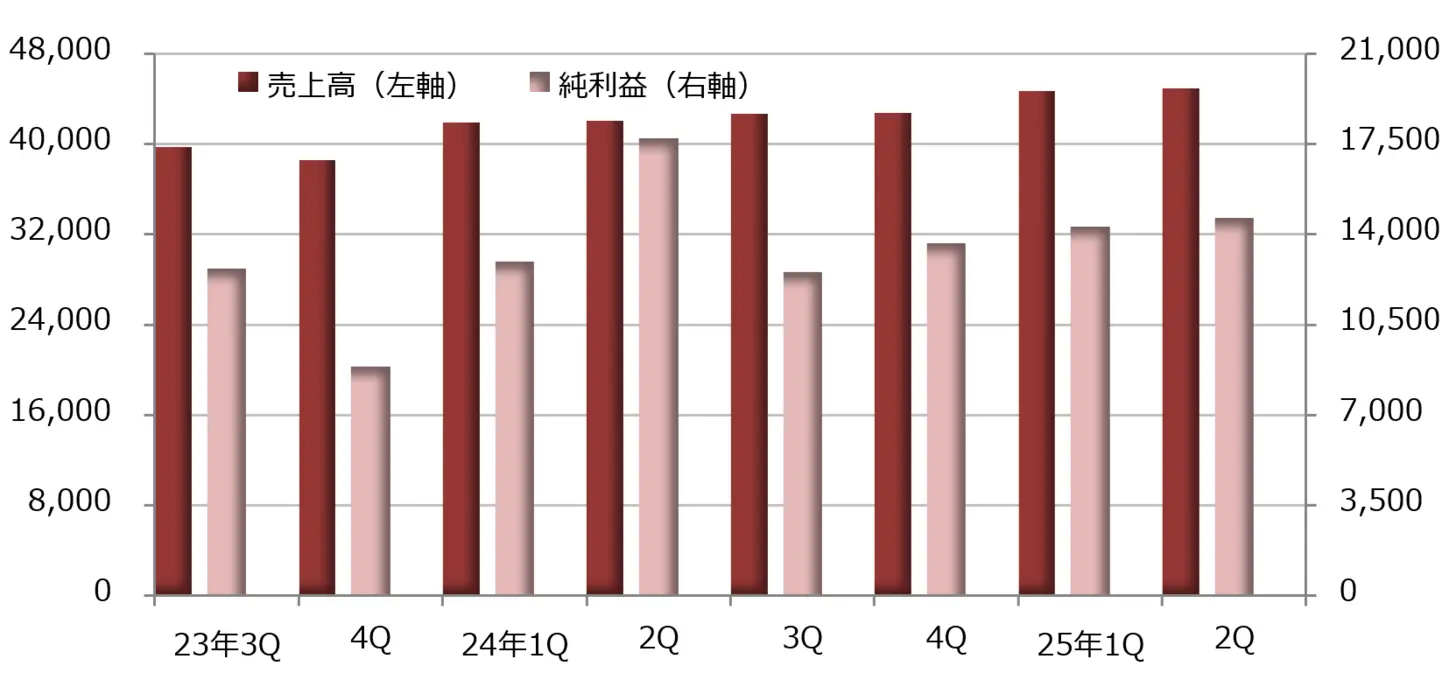

[Figure 1] Micron Technology [MU]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

※The end of the term is in August

Source: Created by DZH Financial Research from LSEG

※The end of the term is in August

[Chart 2] Micron Technology [MU]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of July 18, 2025)

Source: Monex Securities website (as of July 18, 2025)

Delta Air Lines [DAL] reports a 63% increase in net profit for the April-June period, benefiting from reduced fuel costs.

Fuel costs are being compressed due to the decline in crude oil prices.

The financial results for Delta Air Lines [DAL] announced for the April to June 2025 period showed revenue remaining flat compared to the same period last year at $16.648 billion, and net profit increasing by 63% to $2.13 billion. The adjusted EPS (earnings per share) was $2.10, exceeding the market forecast of $2.05 compiled by LSEG by 2.3%.

Despite sales remaining flat, labor costs increased by 10% to $4.42 billion, contract service expenses rose by 11% to $1.155 billion, and departure and arrival costs grew by 15% to $878 million. However, due to a drop in crude oil prices, fuel costs decreased by 13% to $2.458 billion, resulting in an overall increase in operating expenses of only 1%. Fuel consumption increased by 4%, but the average procurement price fell by 16%, leading to a reduction in fuel costs.

On the other hand, in non-recurring profit and loss, investment income rose to $735 million (compared to a loss of $196 million in the same period last year), boosting net profit.

In terms of adjusted non-GAAP (Generally Accepted Accounting Principles) performance, revenue increased by 1% year-on-year to $15.57 billion, while operating profit decreased by 10% to $2.048 billion. Excluding special factors, net profit decreased by 10% to $1.37 billion.

"The best year in Delta Air Lines' 100-year history"

In the trends for the period from April to June 2025, 10 aircraft were delivered. With this, the total deliveries since the beginning of the year amount to 19 aircraft, and since 14 aircraft have been retired, the net increase is 5 aircraft. The aircraft delivered from April to June include the Airbus A350-900, A330-900, A321neo, and A220-300.

The guidance indicated that the adjusted EPS for the full year ending December 2025 is expected to be between $5.25 and $6.25. CEO Ed Bastian suggested in January 2025 that the EPS for the full year ending December 2025 would exceed $7.35, stating that it would be "the best year in Delta Air Lines' 100-year history," but he retracted this forecast during the announcement of the January-March 2025 financial results.

This time, we are reviving the forecast with a downward revision from the predictions made in January. On the other hand, regarding the outlook for the period from July to September 2025, we expect sales to increase by 0-4% compared to the same period last year, an operating profit margin of 9-11%, and EPS of $1.25-$1.75.

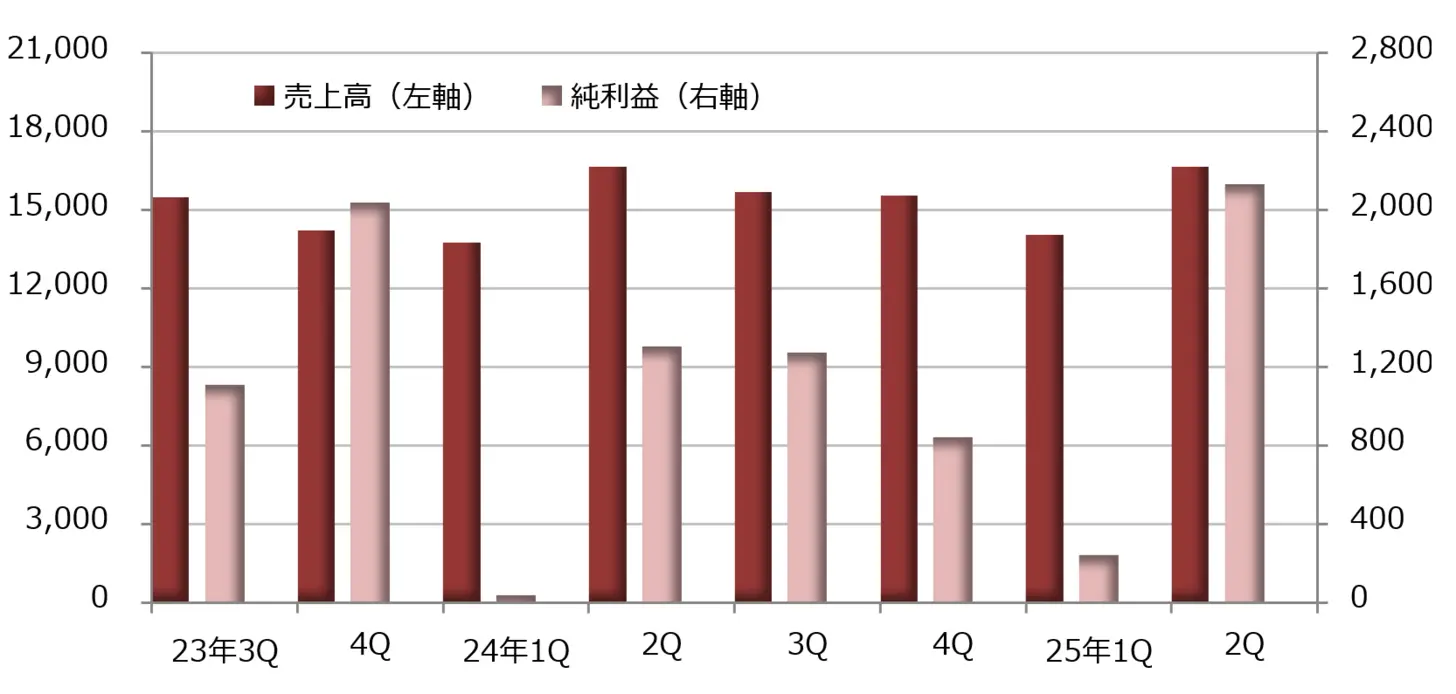

[Figure 3] Delta Air Lines [DAL]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December

[Chart 4] Delta Air Lines [DAL]: Weekly Chart (Moving Averages Green: 13 weeks, Orange: 26 weeks) Source: Monex Securities website (as of July 18, 2025)

Source: Monex Securities website (as of July 18, 2025)

Nike [NKE] struggles, aims to improve performance based on restructuring plan

Nike [NKE] announced that its financial results for the period from March to May 2025 showed a revenue decrease of 12% year-on-year to $11.097 billion, and a net profit decrease of 86% to $211 million. The EPS (earnings per share) was $0.14, exceeding the market expectation of $0.13 compiled by LSEG by 8.6%.

Amid a decline in sales by double digits, the cost of sales decreased by 3% to $6.628 billion, and cost-cutting measures were insufficient, resulting in deteriorating profitability. Furthermore, spending to stimulate demand ballooned by 15% to $1.253 billion, putting pressure on profits.

Nike is currently aiming for a recovery in performance in line with the restructuring plan "Win Now" proposed by CEO Elliott Hill, who took office in October 2024. CFO Matt Friend commented, "The results for the March-May quarter were most affected by Win Now. We expect headwinds to weaken in the future."

For the full year ending in May 2025, the revenue was $46.39 billion, a 10% decrease compared to the previous year, and the net profit was $3.219 billion, a 44% decrease. The drop in revenue, lower gross profit margin, and increased spending aimed at creating demand have all contributed to the decline in net profit.

The CEO of Hill explained, "The performance was within our expectations, but it was not what we were hoping for," and stated, "We expect that advancing Win Now will improve the business."

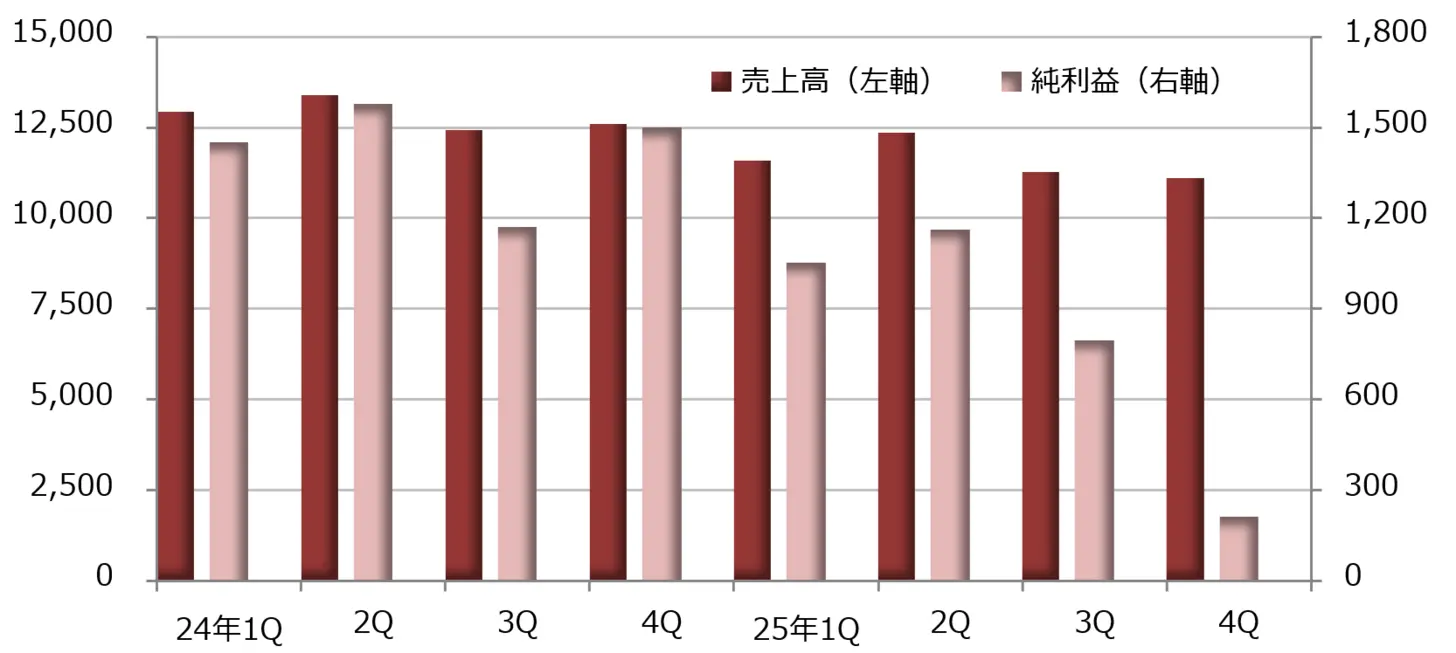

[Figure 5] Nike [NKE]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in May.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in May.

[Chart 6] Nike [NKE]: Weekly Chart (Moving Average Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of July 18, 2025)

Source: Monex Securities website (as of July 18, 2025)

Fasunal [FAST], approximately 10% increase in revenue and profit with outstanding stability

Fasnal [FAST], which manufactures fasteners (industrial fasteners) and machine tools, announced that its financial results for the April to June 2025 period showed a revenue increase of 9% year-on-year to $2.08 billion, and a net profit increase of 13% to $330 million. The EPS (earnings per share) was $0.29, exceeding the market forecast of $0.28 compiled by LSEG by 3.1%.

The market continued to be sluggish, but fluctuations in exchange rates seem to have positively impacted sales revenue. The balance between selling prices and costs improved slightly, with the gross profit margin rising from 45.1% in the same period last year to 45.3%. Although personnel costs increased by 10%, outpacing revenue growth, overall selling and administrative expenses remained at a 9% increase, and operating profit grew by 13% to reach $436 million.

The percentage of sales accounted for by industrial fasteners has decreased from 31.0% in the same period last year to 30.5%. On the other hand, safety products such as reflective jackets, protective clothing, gloves, and traffic cones have increased by 0.4 points, reaching 22.2%. Other products, such as cleaning tools and cutting tools, were up 0.1 points to 47.3%.

Fasnal's stock price is maintaining an upward trend, having updated its all-time high closing price on July 15.

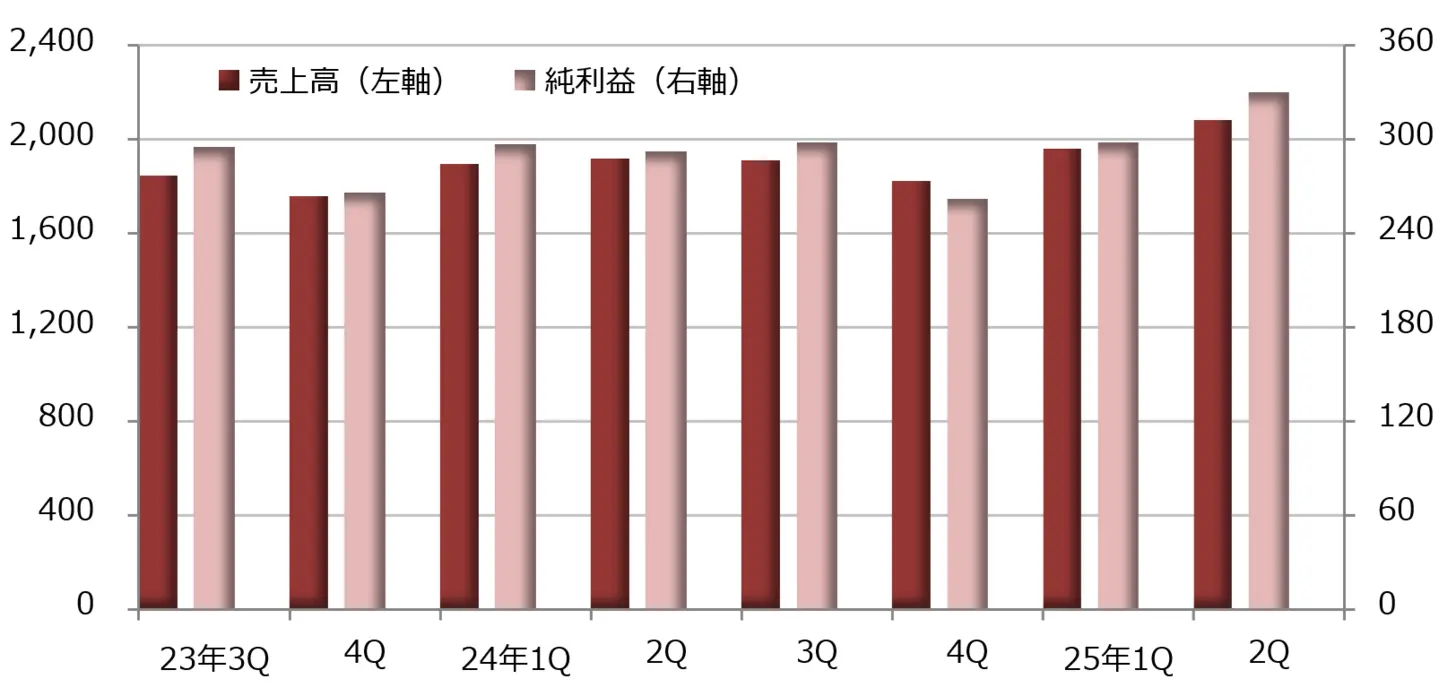

[Figure 7] Fasnal [FAST]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

[Chart 8] Fasunal [FAST]: Weekly Chart (Moving Average Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of July 18, 2025)

Source: Monex Securities website (as of July 18, 2025)

JPMorgan Chase [JPM] reports double-digit revenue and profit growth in market and securities services.

The earnings report for the April to June 2025 period released by JPMorgan Chase, one of the world's leading integrated financial services companies, shows a net operating revenue equivalent to sales of $44.912 billion, a decrease of 11% compared to the previous year, and a net profit of $14.987 billion, down 17%. The adjusted EPS (earnings per share) is $4.96, which is 10.7% higher than the market forecast of $4.48 compiled by LSEG.

By segment, the consumer and community banking business is strong. Non-GAAP net revenue increased by 6% to $18.847 billion, and net income rose by 23% to $5.169 billion. Asset management fees and card income are on the rise.

Commercial and investment banking operations saw a 9% increase in net operating revenue to $19.535 billion, and a 23% increase in net profit to $6.650 billion. Market and securities services experienced double-digit revenue and profit growth.

The asset and wealth management business saw a 10% increase in net operating revenue to $5.76 billion and a 17% increase in net profit to $1.473 billion, also resulting in increased revenue and profit.

[Chart 9] JPMorgan Chase [JPM]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

[Chart 10] JPMorgan Chase [JPM]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of July 18, 2025)

Source: Monex Securities website (as of July 18, 2025)