What is Fly Trade (FLY)?

What Is Fly Trade?

(Source: flytrade_)

Fly Trade is built on a user-centric philosophy and a robust Infrastructure-as-a-Service (IaaS) design, offering an all-in-one trading protocol that unifies cross-chain swaps, best-price execution, smart trading, and chain abstraction. From everyday users to professional traders, anyone can leverage the Fly platform to seamlessly move assets and interact with applications across multiple blockchains.

Key Features of Fly Trade

Advanced Liquidity Aggregation and Best-Price Routing

Fly’s proprietary liquidity aggregation and routing algorithms connect to multiple DEXs and cross-chain resources simultaneously. This ensures the lowest slippage, the lowest fees, and the most favorable pricing—all in real time. This optimizes trade quality while eliminating the risks and uncertainties of third-party aggregators.Infrastructure Access: One-Click Entry for LST, LP, and LRT

Whether you’re engaging in liquid staking (LST), providing liquidity (LP), or participating in restaking markets (LRT), Fly offers a single interface that enables one-click cross-chain asset deployment. API modules allow protocols to directly integrate Fly’s features for seamless cross-chain trading and asset management.Gas Fee Optimization: Reduced Fees

Fly streamlines trade routing and selects the most cost-efficient on-chain nodes, helping users minimize transaction fees. Holders of FLY or related derivative tokens receive additional gas fee discounts.Chain Abstraction: Multi-Chain Switching That Feels Like a Single App

Eliminates the need for constant wallet switching, RPC adjustments, or manual asset bridging. Fly’s user interface hides all these complexities—just select your source and target assets, and the protocol automatically handles the rest, providing a seamless, single-page experience.AI Execution Layer: Powering DeFAI with Intelligent Infrastructure

Fly’s low-latency, non-custodial, and highly scalable infrastructure supports both advanced DeFi operations and an AI-driven trading layer (DeFAI). This encompasses cross-chain swaps, automated strategy execution, stablecoin minting, RWA purchases, and liquidity management.

Fly Trade Use Cases

- Cross-Chain Swaps

- Traditional method: Requires using three or four different sites, bridging, and multiple transactions

- With Fly: Simply select your source and destination assets; complete the cross-chain swap in one click—saving time, reducing hassle, and always securing the best available price.

On-Chain Swap Aggregation

Fly automatically scans liquidity pools across multiple DEXs on a chain and executes swaps at the best price—cutting costs and eliminating the need for manual price checks on each DEX.Asset Deposit, Yield Farming, Lending

With Fly, you can move any asset into LSTs, lending protocols (like AAVE), or upcoming cross-chain NFT markets—all from one convenient entry point.Protocol, DEX, and Wallet Integration

Fly’s API and interface enable other DEXs, dApps, or wallet apps to integrate Fly’s functionality, providing users with direct access to advanced features like cross-chain swaps, lending, and staking.

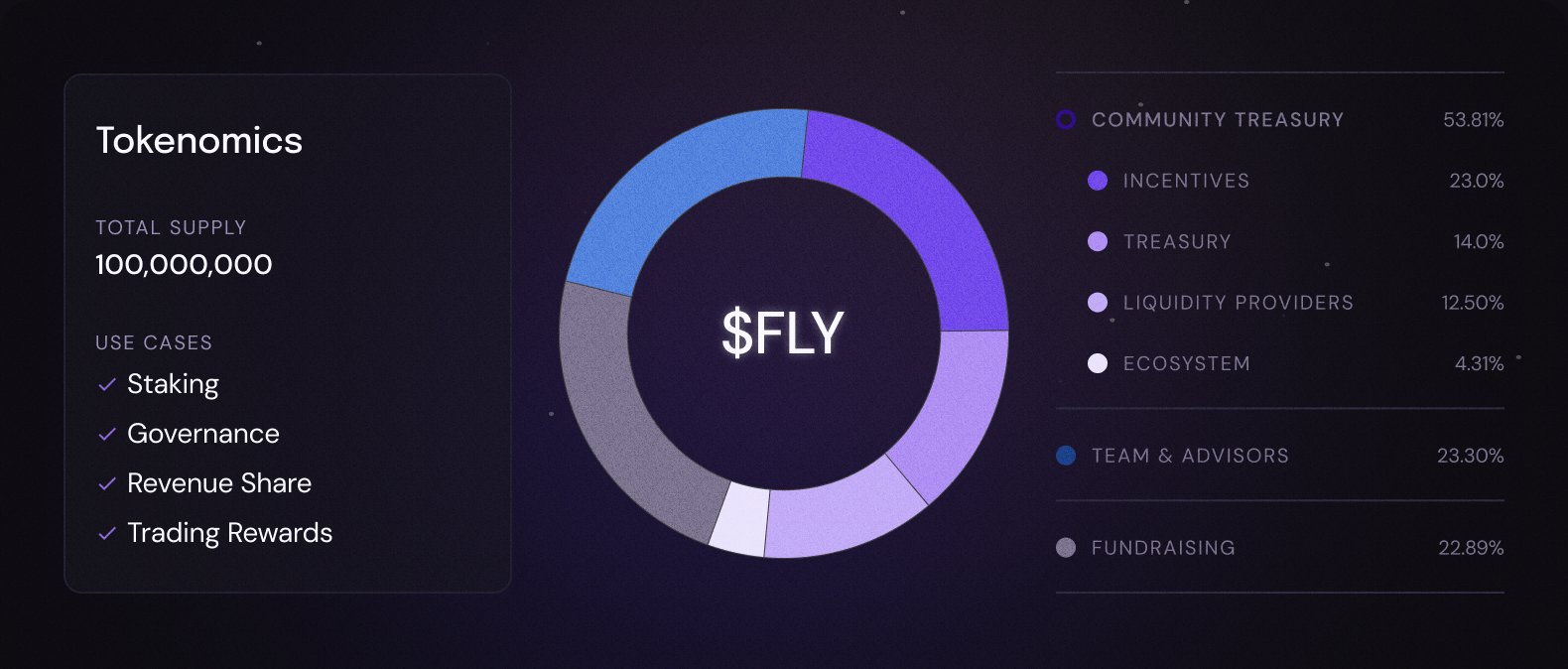

Fly Trade Tokenomics

$FLY has a total supply of 100 million tokens, with allocation designed to emphasize community governance and the protocol’s long-term evolution. $FLY serves multiple roles, including governance, staking, revenue sharing, and trading incentives. Distribution is as follows:

- Community Treasury — 53.81%

The Community Treasury will receive over half of all $FLY tokens to fund future protocol governance, community proposals, liquidity incentives, and a wide range of community initiatives—ensuring steady growth for Fly’s decentralized governance. The treasury consists of four main categories:

Incentives — 23.00%

Dedicated to user rewards and activity incentives, including trading rebates, liquidity contributions, and cross-chain participation. This supports user growth and platform engagement.Treasury — 14.00%

Funds protocol operations, development costs, partnerships, promotions, and potential strategic acquisitions—providing a stable resource base for ongoing innovation.Liquidity Providers — 12.50%

Aimed at establishing and expanding liquidity for DEX trading pairs, this share supports $FLY’s market circulation and price stability.Ecosystem — 4.31%

Reserved for integrating and collaborating with external protocols, such as LST, LRT, lending, and other DeFi components—fostering seamless cross-chain application growth.

Team & Advisors — 23.30%

Allocated to core developers and early advisors for long-term incentives and continued technical contributions. Typically subject to vesting and linear release schedules to ensure lasting alignment and commitment.Fundraising — 22.89%

This share is reserved for early investors and fundraising participants, providing the protocol with launch-stage capital. Appropriate release schedules and risk controls help safeguard healthy tokenomics.

(Source: flytrade_)

Key Utilities of FLY

$FLY is the central token of the Fly Trade ecosystem. It empowers governance, rewards participation, and serves as the gateway for cross-chain transactions and unlocking advanced features. Use cases include:

- Governance Voting: Take part in protocol upgrades and community proposal votes.

- Staking and Rewards: Stake FLY to earn additional yields.

- Gas Fee Discounts: Receive tiered gas discounts based on your WING or xFLY holdings.

- Feature Usage Fees: Actions like cross-chain transactions and API calls require FLY as payment.

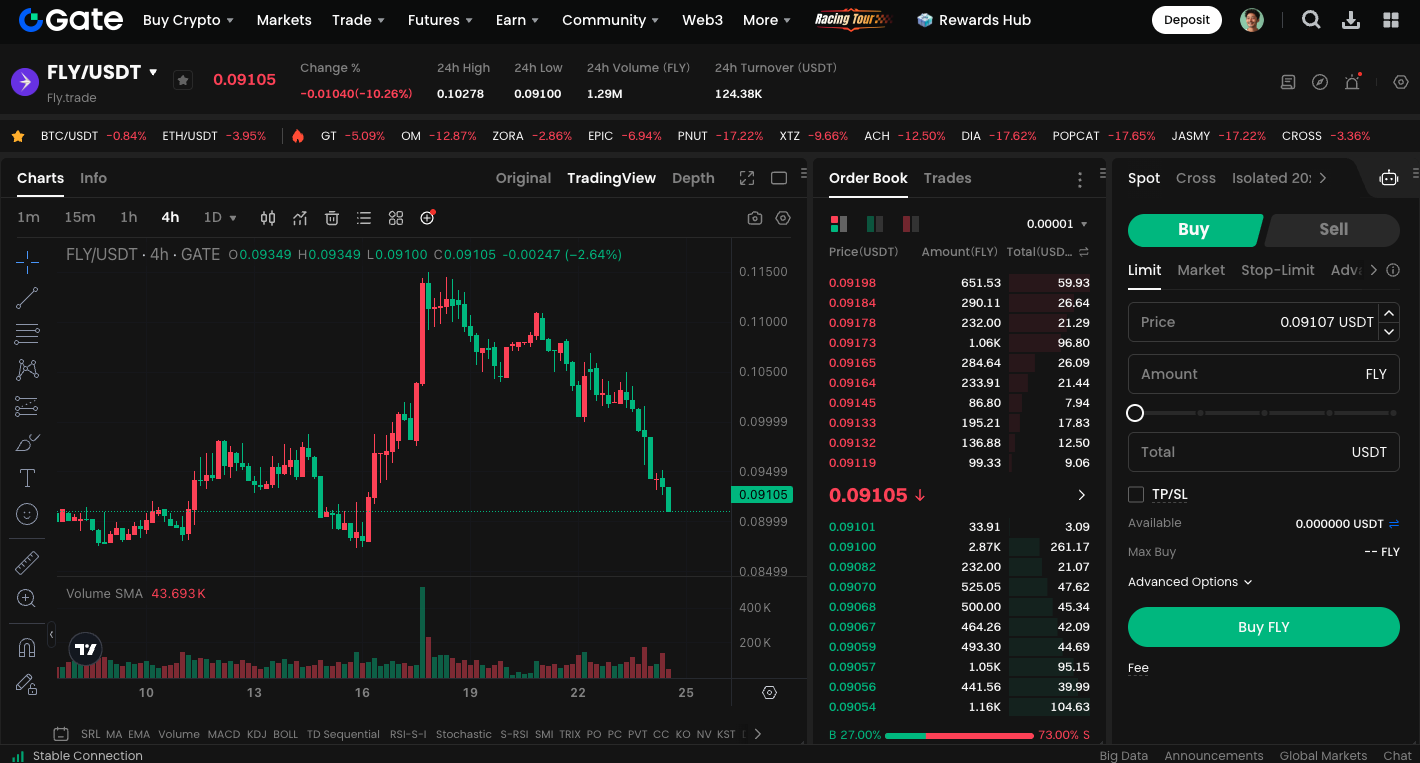

Spot trading for FLY is available at: https://www.gate.com/trade/FLY_USDT

Summary

Fly Trade isn’t just another swap platform—it’s a next-generation infrastructure suite making DeFi universally accessible and borderless. Whether you’re a day trader, institutional market maker, NFT collector, or Web3 developer, Fly’s flexible cross-chain modules and user-centric interface deliver the comprehensive foundation that advanced DEXs need.