Social Tokens 2.0: The Latest Evolution of Blockchain Social Economy and Use Cases

Introduction

Social tokens, as a product of blockchain technology merging with the social economy, have evolved from 1.0 to 2.0. In the 2.0 era, new features such as on-chain identity, privacy protection, multi-chain interoperability, and dynamic incentive mechanisms have emerged, driving the application of social tokens in broader scenarios. This article reviews representative attempts and limitations of the social token 1.0 era, explains the core features and typical cases of the 2.0 era, analyzes new trends in underlying technology, governance design, and incentive mechanisms, dissects challenges faced by the industry and future development prospects, presenting readers with in-depth industry insights in the field of crypto social networking.

First Generation Social Tokens: Dawn and Bottlenecks

Source: https://x.com/friendtech

In the early social token 1.0 era, various innovative attempts emerged like mushrooms after rain, trying to combine traditional social networking with decentralized finance. Representative projects included Steem (a blockchain content platform where users could earn crypto rewards for publishing articles), BitClout/DeSo (a decentralized social media platform where people could “buy shares” in creators, i.e., creator tokens), and creative DAO projects like Friends With Benefits (FWB). In the spring of 2022, projects like “Friends.tech” arose, quantifying Twitter social relationships into tradable tokenized “private chat keys”. These innovations allowed creators and fans to enjoy tokenized belonging and incentive mechanisms to some extent, demonstrating the enormous potential of decentralized social economies.

However, social token 1.0 also exposed many limitations:

Limited user scale: The early main users of these platforms were typically crypto veterans, with low participation from mainstream social users, making it difficult to form extensive social networks.

Technical and cost bottlenecks: Social operations on traditional blockchains often had high costs, large delays, and lacked good interfaces. The user experience was far inferior to Web2 social products, inhibiting large-scale adoption by new users.

Single economic model: Over-reliance on airdrops and token holding thresholds made it difficult for incentive mechanisms to be sustainable in the long term. Many projects quickly accumulated popularity through token rewards in the early stages, but when the speculative frenzy subsided, community activity rapidly declined, even leading to the embarrassment of “few survivors from the 1.0 era”.

Ecosystem fragmentation: Early projects mostly developed independently on their own chains, resulting in serious data island phenomena. Users found it inconvenient to migrate across platforms, hindering the formation of higher-level network effects.

Overall, the social token 1.0 era provided valuable insights for Web3 social networking: it demonstrated the feasibility of decentralized social networking while also exposing many real-world challenges. The new generation of social token 2.0 is exploring evolution based on these experiences, seeking more practical and sustainable solutions through technological and model innovations.

Core Features: Technology and Models of Social Token 2.0

Entering the 2.0 era, social tokens have seen significant upgrades in underlying technology and operational models, with core features including:

On-chain identity authentication: 2.0 projects leverage decentralized identities (DID) and soulbound tokens (SBT) to establish persistent, trustworthy digital identities for users. Users can carry the same on-chain identity across different DApps, maintaining social relationships and reputation scores, truly achieving personal data and social graph independence from any centralized platform.

Privacy protection and ZK technology: The 2.0 era pays more attention to privacy protection needs. Cryptographic technologies like zero-knowledge proofs (ZKP) allow users to selectively disclose information during social interactions, such as proving they meet certain qualifications without revealing private data. This technology helps build privacy-friendly social networks, for example, allowing anonymous voting or discreet credit assessments, avoiding judgments based solely on public wallet data.

Multi-chain interoperability: With today’s diverse public chain ecosystems, social tokens are no longer limited to a single chain. 2.0 projects use cross-chain bridges, unified identity protocols, and other means to allow social relationships and token assets to flow between different chains. Users can link their wallets to identities on multiple chains and participate in cross-chain group interactions. Project teams can also deploy tokens or contracts across chains to attract a wider user base. This multi-chain layout breaks down the data silos that existed between social DApps in the past.

Dynamic incentive mechanisms: Compared to the simple airdrops or token holding rewards of the 1.0 era, incentive schemes in the 2.0 era are more dynamic, able to adjust based on users’ real-time behavior and contributions. For example, through “link mining,” “content writing for money,” and “community collaboration rewards,” users are incentivized to participate in real-time, ensuring they receive ongoing economic returns from social interactions. Project teams adopt complex indicator evaluation systems (combining post quality, interaction volume, reputation, etc.) to distribute token rewards to users who truly contribute value. Additionally, some platforms design growth-oriented token economics, increasing incentives as the community scales, avoiding early users gaining too much advantage and ensuring the fairness and sustainability of the incentive mechanism.

Open social protocols: More developer-oriented social protocols have emerged at the underlying level, such as Lens Protocol and CyberConnect, which are open-source social graph protocols. These protocols map social relationships, follows, reposts, and other behaviors to on-chain data, which any application can call upon to support the integration of social features. 2.0 projects can more easily build social networks using these protocols, and potentially achieve social asset interoperability between different applications.

These features work together to transform social tokens from a pure “Token + Community” model to a richer ecosystem: it not only emphasizes user data and identity autonomy but also allows the value behind social behaviors (such as content creation, interaction quality) to be finely recorded and rewarded on-chain. This lays the foundation for the realization of true “digital social + finance”.

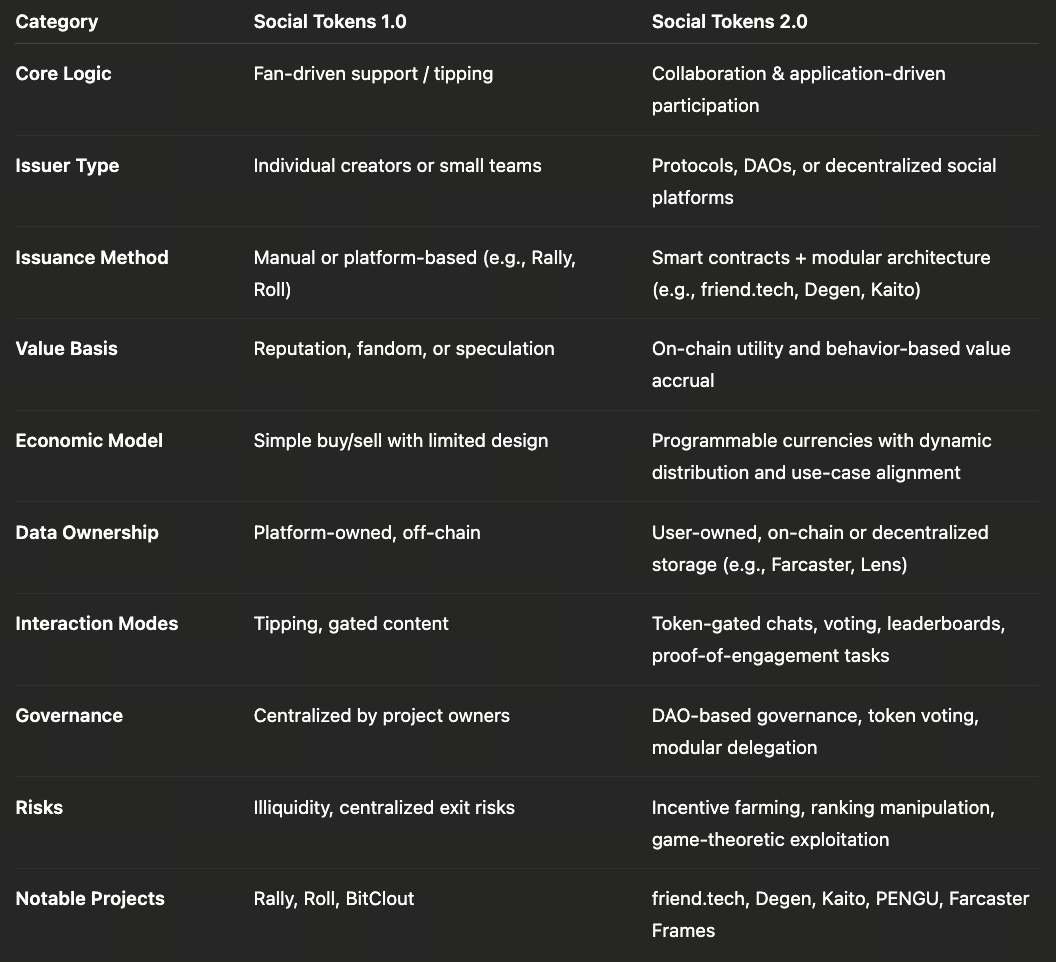

Social Token 1.0 / 2.0 Comparison Table (Source: Gate Learn Creator Max)

Entering the social token 2.0 era, projects like $FWB, $PENGU, $KAITO not only focus on on-chain issuance and transparent governance but also integrate mechanisms such as content incentives, knowledge economy, and personal asset tokenization. Technologically, they often combine on-chain subscriptions, modular contracts, L2 and zk technologies, with more refined incentives and a more three-dimensional ecosystem, truly moving towards the multi-dimensional realization of “social as an asset”.

Typical Project Cases: User Value and Community-Driven in Real-World Scenarios

The 2.0 era has seen a batch of exploratory projects emerge, demonstrating from different angles how social tokens can inspire user value and drive community development in practical scenarios.

Friends With Benefits ($FWB)

Image: https://www.fwbfest.info/

FWB is one of the early representatives in the social token field. It operates in the form of tokens combined with a Discord community: only users holding a certain amount of FWB tokens can join the community and participate in decision-making. This model has made the FWB community a hub for artists, creators, and blockchain enthusiasts. FWB not only built an online “membership system” but also organizes offline art exhibitions, parties, creator workshops, and even independently publishes cultural content and sells merchandise. By equating tokens with membership, FWB allows community members to share benefits and prestige through mutual collaboration, increasing community belonging. Although FWB’s popularity has declined in later stages, its exploration in creator economy and community self-governance has provided valuable experience for subsequent projects.

KAITO ($KAITO)

Source: https://yaps.kaito.ai/

KAITO is a crypto information platform combining artificial intelligence and social rewards, known as the InfoFi (Information Finance) ecosystem. It uses AI-driven data mining and intelligence analysis to aggregate massive crypto-related information from Twitter, forums, news, etc., while introducing a “Tokenized Attention” mechanism. The platform scores user-generated content through the “Kaito Yaps” feature, with evaluation indicators including post quality, interaction depth, and professionalism. Quality content publishers and active commenters can receive KAITO token rewards. Additionally, KAITO collaborates with other projects to host social mining events, offering generous airdrops to participants. Through this dynamic content incentive, KAITO not only improves information dissemination efficiency but also allows ordinary users’ content creation power to receive economic returns, promoting a community ecosystem built by content creators and information seekers.

UXLINK ($UXLINK)

Source: https://dapp.uxlink.io/

UXLINK is a Web3 platform focusing on “acquaintance social” scenarios, with its core experience built within the Telegram chat ecosystem. Through modules such as social mining (users can earn tokens for daily social behaviors), social decentralized exchanges (asset trading within chats), and liquidity staking, it provides users with a low-barrier crypto social experience. The project adopts a dual-token model: UXUY as a community incentive token and UXLINK as a governance token.

Furthermore, UXLINK connects communities, developers, and partners closely through large-scale airdrop activities linking multiple exchanges and platforms. Users only need to use Telegram to participate in this ecosystem, achieving a low-barrier crypto social experience. In a short time, UXLINK has attracted millions of registered users, thousands of active groups, and successfully formed a multi-chain social network. Its success experience is: by integrating with mainstream social tools and providing immediately visible economic incentives, traditional social behaviors can be quickly combined with token economics.

The above cases show that social token 2.0 projects often focus on closely binding tokens with specific social rights, content production, or community activities, allowing users to truly enjoy economic value in social interactions. For example, token value is realized through diverse scenarios such as offline events, content contributions, and interactive behaviors. Unlike the “airdrop prosperity” intention of the 1.0 era, 2.0 projects tend to build endogenous ecosystems: only when users actually feel the convenience and belonging brought by holding tokens can the community gain stable and sustainable development momentum.

New Trends and Innovations: Underlying Technology, Governance, and Incentive Mechanisms

Social tokens in the 2.0 era are innovating on multiple levels, with the following trends particularly worth noting:

Protocol-based infrastructure: The construction of social protocol layers is accelerating, with projects like Lens and CyberConnect providing composable social graphs. New protocols allow developers to call shared social relationship data (follows, fans, interaction records, etc.) in their own applications, achieving cross-application interoperability of accounts and social assets. Additionally, some projects are beginning to build social data oracles, bringing off-chain social activity data on-chain to support user profiling and behavioral analysis for DApps.

Multi-token governance models: More projects are adopting multi-token or multi-role governance structures, clarifying the utility and value capture responsibilities of tokens. The “dual-token” model represented by UXLINK (one for daily incentives, one for equity governance) is becoming popular, helping to reduce conflicts between the community and founding team. Meanwhile, governance voting methods are also diversifying, potentially combining factors such as token staking duration, holding amount, participation level, and specific NFTs to encourage long-term commitment and community contribution.

Dynamic economics in smart contracts: Social token ecosystems are increasingly adopting algorithmic and automated mechanisms to balance economic incentives. For example, introducing calculation rules such as time weighting, reputation scores, and activity bonuses to gradually increase rewards for long-term participation and contribution. Some projects also use economic measures like curve financing and dynamic rates to automatically adjust incentive scale and distribution strategies based on community size and market conditions, enhancing ecosystem resilience.

Content quality and anti-spam strategies: To maintain community quality, 2.0 projects emphasize quality assessment of content or interactions in incentive design, such as using AI and machine learning to identify originality, depth, and professionalism, rather than purely quantitative indicators. Meanwhile, built-in anti-spam mechanisms (such as anti-bot reviews, community voting reports, etc.) have become the norm, striving to concentrate value on truly active contributors.

Cross-domain integration and vertical innovation: Beyond social networking itself, social token 2.0 is constantly expanding in application scenarios. Some projects combine tokens with NFTs, games, and other fields, such as new credit systems based on SBTs or NFT authentication; some introduce social token mechanisms into traditional industry scenarios, such as converting community activity into real product discounts or service rights. These cross-domain attempts enrich the usable scenarios of social tokens, bringing more convenience and value to users.

Overall, the innovation of social token 2.0 is not only reflected in individual products but also in its promotion of the integration of multi-dimensional ecosystems such as social and finance, data and identity. This open and collaborative trend will determine the evolutionary direction of future social platforms.

Analysis of Project Failure Cases: Lessons from Social Token 1.0

Although the concept of social tokens has been emerging since 2021, most of the earliest pioneers failed, with highly similar reasons for failure, mainly concentrated in mechanism design, user stickiness, and asset expectations.

1. BitClout / DeSo: The Trap of Unauthorized Celebrity Speculation

BitClout (later renamed DeSo) was one of the earliest projects to attempt linking Twitter celebrities with tokens, allowing users to create “creator coins” around figures like Elon Musk and Vitalik for speculation. However, its biggest problems were:

Lack of celebrity authorization: Tokens were completely disconnected from real creators, causing user confusion and PR crises;

Speculation over use: Most users came only for short-term gains, lacking real interaction and content production;

Outdated on-chain infrastructure: DeSo built its own chain, resulting in ecosystem isolation and lack of support from mainstream wallets and exchanges.

As a result: After the speculative peak in 2021, BitClout quickly faded into obscurity, becoming a cautionary tale of “Web3 celebrity coins”.

2. Rally: Semi-On-Chain Closed System Unable to Support Trust

Rally attempted to issue independent sub-tokens for creators and provide trading, tipping, and community functions through its self-built “Creator Coin” platform. The project initially attracted many musicians, YouTubers, and niche fan circles, but failed critically due to:

Highly centralized architecture: The project was hosted on private chains and platforms, leaving user assets not truly controllable;

Severe incentive inflation: Continuous release of RLY parent coins to attract Creators, ultimately diluting value;

Unclear exit mechanisms: Many users holding sub-coins lacked liquidity, ultimately losing everything.

In 2023, Rally announced “platform closure and fund redemption stoppage”, becoming a painful lesson in crypto content economics.

3. $STARS (Starname): Failed Attempt at On-Chain Identity Binding

$STARS hoped to promote social interaction and tokenized incentives through an on-chain username/identity system. But the problems were:

Lack of strong user network: Users were limited to the extremely small Cosmos community, failing to establish a Creator incentive loop;

Lack of actual interaction scenarios: Social functions remained at the level of domain name registration and display, lacking content contribution mechanisms;

Expectation gap and price collapse: The project was initially packaged as “on-chain ENS + social graph”, attracting speculative funds, but actual performance later fell far short of the narrative.

Today, $STARS is nearly zeroed out, reflecting the inherent limitations of “identity first, social lagging” in on-chain ecosystems.

Lessons Learned

The core lessons from these failure cases include:

Without “real creator relationship binding”, social tokens are just empty shells for speculation;

Without “on-chain asset controllability”, user trust cannot be maintained;

Without “continuous content-driven and interactive mechanisms”, user growth can only be fleeting;

Without “sufficient exit mechanisms and token recycling logic”, incentive systems will eventually collapse.

Conclusion: The Future of Social Tokens Has Arrived, Inflection Point Emerging

Social tokens are standing at the critical point of transition from 1.0 to 2.0. From the speculative experiment of “people as assets” to the protocol economy of “social as network”, with the rise of new generation projects like Kaito, philand, and PENGU, we see crypto social networking beginning to move away from the singular “buy and sell people” gameplay, evolving towards functional

Share

Content