Golden Cross Explained: How Beginners Can Interpret Crypto Market Signals

What Is a Golden Cross

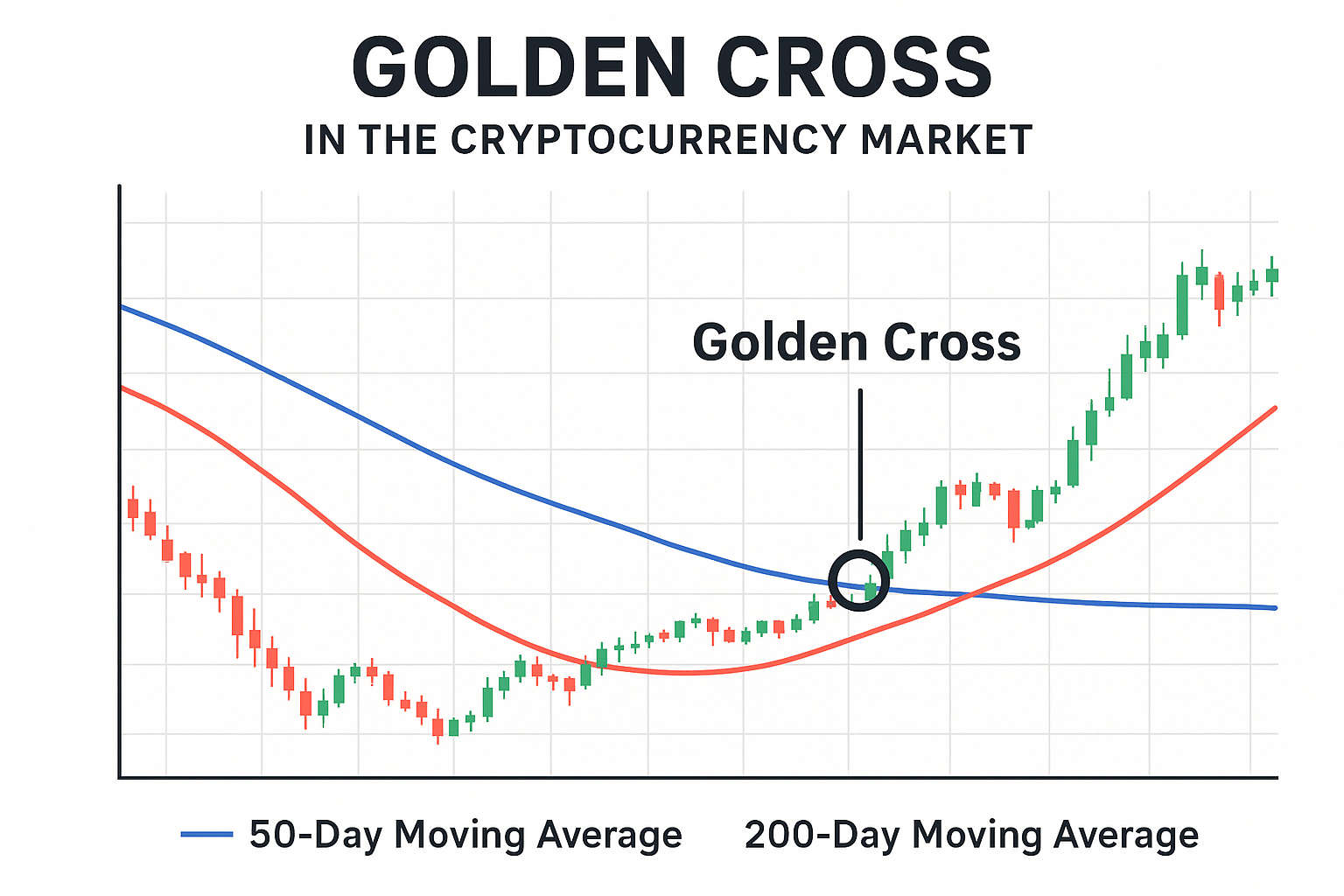

A golden cross is a technical analysis pattern in the crypto market, where a short-term moving average—such as the 50-day moving average—crosses above a long-term moving average—such as the 200-day moving average. Many traders interpret this crossover as a signal that the market is transitioning from a downtrend to an uptrend. The golden cross helps investors find good entry points and take advantage of potential upward movement.

What Conditions Create a Golden Cross

Generally, the golden cross forms when the following conditions are met:

- Short-term moving average crosses above long-term moving average: The short-term moving average (e.g., 20-day or 50-day moving average) breaks upward through the long-term moving average (e.g., 100-day or 200-day moving average).

- Volume confirmation: The golden cross occurs alongside higher trading volume, showing greater market participation and acceptance of the trend change.

- Trend confirmation: After the crossover, price stays above the moving averages, which reduces the risk of false signals.

Significance of the Golden Cross

The golden cross is more than just a convergence of moving averages. It signals stronger bullish momentum in the crypto market as investor sentiment shifts from cautious to optimistic. This pattern often suggests the market may reverse from a bear to a bull market. It also points to stronger buy signals and more chances for short-term profits. Investors can use the golden cross to find opportunities for medium- and long-term investments.

How to Use the Golden Cross in Real Trading

Investors can use the golden cross in the following ways:

- Follow market trends: When a golden cross appears, consider gradually starting or adding to positions.

- Set stop-losses: Place stop-losses at support levels below the moving averages to manage risk.

- Use complementary technical indicators: Combine the golden cross with other signals like MACD or RSI to improve reliability.

Important Considerations and Risk Notice

While many investors regard the golden cross as a bullish signal, it’s important to be aware of these risks:

- False signals: In sideways or volatile markets, moving average crossovers can happen often, leading to misjudgments.

- Fundamental analysis: Relying only on technical indicators may cause investors to miss important market fundamentals.

- Capital management: Use sensible position sizes to avoid major losses from entering positions during rapid price increases.

In conclusion, the golden cross is not just a technical chart pattern—it is an indicator of changing market trends. New investors should use it along with other analytical tools. Developing a clear investment strategy can help you navigate the crypto market more confidently.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025